Buyouts

Castik sells Acrotec to Carlyle

Precision parts producer was valued at CHF 280m when it was acquired by Castik in 2016

Investindustrial to take control of Guala

Investindustrial plans to launch a full takeover offer for Guala, at €8.20 per share

Korona Invest acquires stake in Enmac

Enmac is GP's sixth investment from the fund, which was 50% deployed following its fifth investment in April 2020

EQT sells Apleona to PAI for €1.6bn

Deal is PAI's first in the DACH region since appointing Ralph Heuwing as partner and head of DACH

Sovereign Capital backs Zenitech

Sovereign backs Zenitech founders Christopher Lacy-Hulbert, Edward Batrouni and Csaba Suket

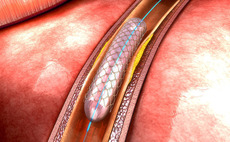

Gyrus buys LivaNova heart valve business for €60m

Gyrus has also made an offer for the heart valve's French division, but a decision remains to be made

GED buys four health services

GP deploys capital from GED VI España, which was launched with a €175m target and held a €100m first close in 2019

Gimv sells Climate for Life to Parcom

Gimv formed the climate control business in 2016 by merging Itho Daalderop and Klimaatgarant

Wise acquires Cantiere del Pardo

GP invests in the company via Wisequity V, which closed on its €260m hard-cap in July 2019

Verdane, Canica acquire Porterbuddy

Investment reportedly gives the company a valuation of NOK 200m, up from NOK 120m a year ago

THI invests in Corndel

Corndel, an education provider, will focus on developing its training offering with the new investment

Triton acquires Inwerk

Acquisition of the office furniture producer is the 10th from Triton's Smaller Mid-Cap Fund

Via Equity sells Profit Software to Volpi

Sale comes six years after the GP, alongside Tesi, acquired the company from CapMan

Cinven, BCI to acquire Compre from CBPE

This is Cinven VII's third acquisition following the purchase of LGC and Thyssenkrupp Elevator

Perwyn acquires Agilitas from NVM for 8.4x returns

Agilitas recorded revenues of ТЃ12m in the year to March 2019, up from ТЃ9m in the same preceding period

Nazca acquires Filmin

With Nazca's support, Filmin intends to consolidate its market position in Iberia and broaden its product offering

Monterro buys SaaS company TimeEdit

GP has reportedly acquired a stake of around 75% for almost SEK 100m (тЌ9.8m)

Quadrivio backs EPI

GP invests in the company via its Industry 4.0 fund, which was launched with a €300m target in 2018

Investindustrial buys Campus Training

GP intends to create a platform for new acquisitions across the professional education sector in Spain

Capita in exclusive talks with Montagu to sell its ESS division

Capita engaged with Goldman Sachs in June 2020 to sell the asset for around ТЃ500-700m

CVC makes €175m offer for Vivartia

Marfin Investment Group, the Greek financial entity, is the vendor of the company

Axcel buys three staffing agencies

Combined group generates revenues of DKK 850m and employs 150 staff across 11 offices in Denmark

Chequers, Paragon to acquire Silverfleet's 7days

Sale process for the medical workwear company saw interest from FSN and Gilde, Mergermarket reported

EMZ Partners acquires Assepro

Buyout of the Switzerland-based insurance broker is EMZ's third DACH region deal of 2020