Exits

Nordwind sells SHW stake

Nordwind Capital has sold its remaining 58% stake in listed German automotive supplier SHW for €132.6m, according to reports.

3i acquires Allianz's Scandlines stake

3i Group has agreed to acquire co-investor Allianz Capital Partners’ stake in ferry operator Scandlines.

UK plc to overlook Europe

UK plc is to look further overseas, to destinations including the US, India, Brazil and China, for new acquisitions, diminishing a key exit route for European private equity-backed businesses.

3i-backed Everis sold to NTT Data

Japanese IT services company NTT Data has wholly acquired Spanish business consultancy firm Everis, giving an exit to 3i, Hutton Collins, Grupo Landon and Ariadne.

Gresham divests Swift

Gresham Private Equity has sold oil & gas recruitment company Swift Technical Group to Wellspring Capital Management.

LDC sells Mountain Warehouse to management

LDC has divested Mountain Warehouse, a UK-based outdoor clothing and equipment retailer, in a management buy-back worth ТЃ85m.

Terra Firma to refinance Tank & Rast's €2.1bn debt

Terra Firma is currently considering a refinancing of motorway service operator Tank & Rast's €2.1bn debt load.

Blackstone and N+1 Mercapital sell Mivisa for €1.2bn

Blackstone and N+1 Mercapital have sold tinplate packaging manufacturer Mivisa to Crown Holdings in a €1.2bn transaction.

OEP's Constantia Flexibles confirms IPO

Austrian packaging manufacturer Constantia Flexibles, backed by One Equity Partners (OEP), has confirmed plans to float before year-end.

HgCapital exits Epyx, reaps 2.7x return

HgCapital has sold UK-based Epyx to NYSE-listed fuel payment processing company Fleetcor, making 2.7x its original investment and a gross IRR of around 27%.

Graphite makes 3.5x on Alexander Mann Solutions sale

Graphite Capital has sold Alexander Mann Solutions (AMS) for ТЃ260m to New York-based New Mountain Capital, reaping a 3.5x return on its initial investment.

N+1 Mercapital avoids write-off with Hoteles Tecnológicos sale

N+1 Mercapital has sold Hoteles Tecnológicos in a partial exit from hotel group High Tech Hoteles & Resorts.

Just Retirement targets £1bn+ market cap

Permira-backed Just Retirement is hoping to achieve a market capitalisation of between ТЃ1-1.25bn after it began its investor road show yesterday.

VC-backed Criteo raises $250m in IPO

French advertisement targeting company Criteo, backed by several venture capital firms, has raised $250m in its IPO on Nasdaq.

Saga expected to raise £3bn in IPO

Saga, part of Acromas, backed by CVC, Charterhouse and Permira, has hired STJ Advisors in advance of an expected ТЃ3bn public offering.

LDC reaps 2.4x in JCC Lighting exit

LDC has sold lighting manufacturer JCC Lighting (JCC) to US electrical manufacturer Leviton, reaping a 2.4x money multiple.

Isis reaps 4.8x on sale of CableCom to Inflexion

Isis Equity Partners has sold CableCom Networking, a UK-based internet and digital media services provider, to Inflexion Private Equity, reaping a 4.8x return.

Cinven looking to offload Gondola

Cinven is appointing advisers to review its options for restaurant group Gondola Holdings, the parent company of PizzaExpress, Ask and Zizzi.

KKR's ATU receives $25m and nears debt restructuring

KKR’s problem child Auto-Teile Unger (ATU) has entered an agreement with creditors in order to reduce its debt and receive a $25m liquidity injection.

Wonga buys VC-backed Billpay

Cash lender business Wonga, backed by a consortium of venture capital firms, has acquired online payment business Billpay, a portfolio company of numerous German VCs.

GCP rebrands to Kester and offloads TEG

The former European private equity division of Greenhill & Co, GCP Capital Partners, has simultaneously rebranded as Kester Capital and divested Travel Entertainment Group (TEG).

PE-backed TDF attracts €3.5-3.6bn offers

The private equity backers of broadcast tower operator Télédiffusion de France (TDF) are considering bids in the region of €3.5bn for the sale of the firm’s French unit, Reuters has reported.

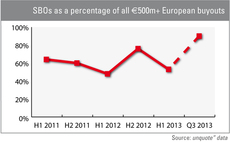

SBOs account for 90% of €500m+ dealflow in Q3

The latest quarterly figures from unquote" data show that while the wave of secondary buyouts seems to have hit its apex in overall volume terms, such deals are still disproportionally prominent in the large-cap space.