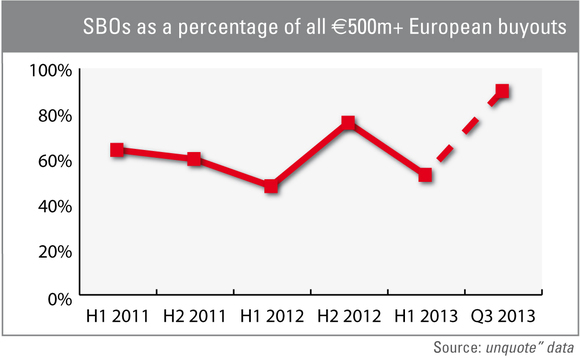

SBOs account for 90% of €500m+ dealflow in Q3

The latest quarterly figures from unquote" data show that while the wave of secondary buyouts seems to have hit its apex in overall volume terms, such deals are still disproportionally prominent in the large-cap space.

SBOs always tend to be more prevalent at the upper end of the market – but Q3 stuck to the trend in spectacular fashion, with a whopping nine out of 10 buyouts valued at more than €500m being sourced from other GPs. These included Pamplona buying OGF from Astorg for an estimated €900m and CVC acquiring Domestic & General from Advent International in a deal valued at around £750m.

While the contribution of SBOs to the overall value of buyouts is also marginally less significant than in the first two quarters of the year (62% in Q3 against 64% across H1 2013), it remains high by historical standards – in the first half of 2012, SBOs "only" accounted for 39% of all buyouts in value terms.

In volume terms, around 38% of buyouts completed across Europe in Q3 were sourced from another private equity house. The figure is an improvement on the first half of 2013 (44%), but still higher than those seen in years past – again, SBOs only accounted for 27% of all buyouts in the first half of last year.

All data is sourced from unquote" data, the unquote" proprietary database. To conduct your own searches on pan-European private equity trends, visit unquotedata.com

For a more in-depth analysis of Q3 activity figures, look out for the next edition of the unquote" Private Equity Barometer, published in association with SL Capital in the coming weeks.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds