Exits

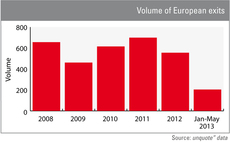

2013 exit activity on course to match quiet 2012

Divestment activity figures so far this year highlight the exit environment remains tough for GPs looking to return cash to investors – although recent weeks have seen positive trends unfolding.

Sentica's atBusiness merges with Innofactor

Sentica Partners Oy has sold Finnish technology company atBusiness to Innofactor.

EQT's Springer Science still in dual-track process

BC Partners is reportedly left as the sole bidder for EQT portfolio company Springer Science, which announced IPO plans last week.

Northzone et al. exit Energy Micro to Silicon Labs for $170m

Northzone and Investinor have exited Norwegian company Energy Micro AS to Nasdaq-listed Silicon Labs for $170m, reaping a 2.5x multiple on their original investments.

Mobeus reaps 2x on BIH exit

Mobeus Equity Partners has divested the main operating facility of British International Helicopter Services (BIH) to trade player Patriot Aerospace Group, realising a 2x return.

Deutsche Annington to list ahead of Terra Firma fundraise

Deutsche Annington, the German real estate group backed by Terra Firma, has confirmed it will list on the Frankfurt Stock Exchange this year.

NVM achieves 3.3x on IG exit

NVM Private Equity has sold IG Doors to the HУЖrmann Group, generating an IRR of 17.3% and a 3.3x money multiple.

Cinven's Avio Spazio attracts trade buyers

Preliminary offers for Avio Spazio, owned by Cinven and Italian defence group Finmeccanica, are expected by the end of June according to reports in the local press.

Agilitas buys ISS division in maiden investment

Mid-cap GP Agilitas Partners has backed the management buyout of ISS Damage Control from EQT-backed ISS Group.

AA and Saga looking to refinance, then split

The AA group and Saga, backed by CVC, Charterhouse and Permira, are to issue a long-term bond to refinance £4bn of bank debt, which could lead to a break-up.

Dunedin backs £43m Trustmarque secondary buyout

Mid-market GP Dunedin has backed the ТЃ43m management buyout of Trustmarque Solutions, a technology services and solutions provider, from LDC.

Doughty divests Vue to Omers and Alberta for £935m

Doughty Hanson has sold cinema group Vue Entertainment to Omers Private Equity and Alberta Investment Management Corporation (AIMCo) for an enterprise value of ТЃ935m.

CVC to sell 32.5% stake in bpost IPO

CVC Capital Partners plans to sell a stake of up to 32.5% in the IPO of bpost at a price of €14.5 per share.

BC brings in the banks for Foxtons float

BC Partners has hired Credit Suisse, Numis Securities and Canaccord Genuity to handle the flotation of London estate agency Foxtons.

Cinven to reap 7x from Partnership IPO

Cinven-backed Partnership Assurance Group (PAG) has listed on the London Stock Exchange, in an IPO valuing the business at ТЃ1.54bn.

Vermeer Capital buys RLD from Sagard

Vermeer Capital has acquired a majority stake in RLD, a French business specialising in the rental and laundering of workwear, from fellow GP Sagard.

Montagu sells Hansen Protection to IK

Montagu Private Equity has agreed to sell Norwegian protective clothing company Hansen Protection to IK Investment Partners.

EQT's Springer Science aiming to raise €760m in IPO

Springer Science, a German publishing business owned by EQT, has confirmed plans to list on the Frankfurt Stock Exchange before the summer break.

CVC's bpost shares to sell for €12.5-15

Shares in bpost, the Belgian postal service backed by CVC, will sell for €12.5-15 in the business's upcoming IPO, according to reports.

VC-backed Cardio3 announces IPO plans

Belgian biopharmaceutical company Cardio3 Biosciences, which is backed by a consortium of venture capital firms, has announced that it is considering listing new shares in an IPO.

Aksìa sells Plastiape for €71m

Italian GP Aksìa Group has fully exited packaging solutions firm Plastiape Group, selling the company to PM & Partners for an enterprise value of €71m (around 7x EBITDA).

Lion cleared to sell Ad van Geloven stake to Avedon

Lion Capital has received clearance from the European Commission to sell a stake in Dutch frozen snack company Ad van Geloven to Avedon Capital Partners.

Magnum Capital buys Iberchem

Spanish GP Magnum Capital has acquired a majority stake in Iberchem, a Spanish fragrances producer, from Capital Alianza.

Riverside sells Oni to Altice

The Riverside Company has sold its 60.9% stake in Portuguese telecommunications company Oni Telecom to investment company Altice.