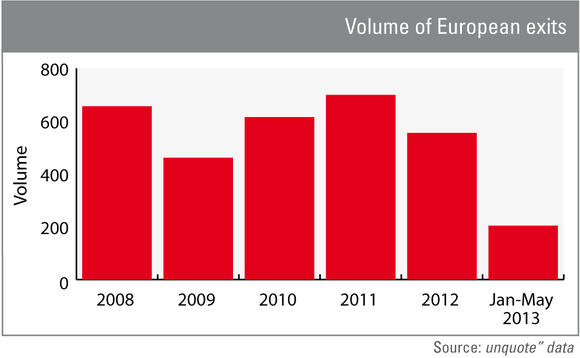

2013 exit activity on course to match quiet 2012

Divestment activity figures so far this year highlight the exit environment remains tough for GPs looking to return cash to investors – although recent weeks have seen positive trends unfolding.

With 204 portfolio companies divested between January and May, according to unquote" data, exit activity for this year looks set to be roughly on par with the volume of divestments seen in 2012. But with 555 exits recorded, last year was already quiet and failed to match the 615 and 699 transactions seen in 2010 and 2011 respectively.

It is not as if portfolios were already depleted following these two strong vintages: as unquote" revealed recently, 44% of all European buyouts completed in 2006 are still in fund portfolios, and 57% of investments done in 2007 are yet to be realised.

Looking at the exit landscape so far this year further highlights the difficulties faced by GPs looking to divest businesses. Secondary buyouts have accounted for 28% of all exits in volume so far this year, against 21% in 2012. Trade sales have meanwhile taken a slight hit from 41% of all exits last year to 39% so far in 2013. Partial sales also made for a higher proportion of all divestments in the first few months of the year (10% against 8% in 2012), as several GPs chose to offload their assets incrementally.

It is not all doom and gloom though, as recent weeks have seen more positive developments taking place in the exit space. First of all, large-cap divestment activity has bounced back in the second quarter after a slow start to the year: even though Q2 is still ongoing, unquote" recorded 12 exits valued at more than €500m, double the volume seen for the whole of Q1.

An exit road less troden also looks set for a spectacular comeback, based on recent news. IPO activity in the first quarter has already dwarfed the whole of 2012, and announcements have kept coming in Q2. Recent large flotations notbaly include Cinven-backed Partnership Assurance Group listing on the London Stock Exchange at the beginning of June in an IPO valuing the business at £1.54bn.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds