Exits

Capiton buys Kautex Maschinenbau from Steadfast

Capiton AG has acquired German manufacturer Kautex Maschinenbau in an SBO from Steadfast Capital valued at €50-100m.

Hamilton Portfolio exits Global Expense

Hamilton Portfolio has sold UK-based expenses management firm Global Expense to US trade buyer Concur for ТЃ14m.

Panoramic marks first exit with 120% IRR Solfex sale

Panoramic Growth Equity has sold renewable energy distribution specialist business Solfex Energy Systems to Travis Perkins for more than ТЃ30m, according to a source.

Equistone IV to sign ninth deal

Equistone Partners, which has recently closed its Equistone IV fund on €1.5bn, is set to acquire French food machinery business Groupe Brétèche, according to a filing made with the French competition authority.

Encore Capital exits Pro Bike Kit

Encore Capital has sold online cycling retailer Pro Bike Kit (PBK) to e-commerce firm The Hut Group.

Siparex et al. take stake in Malherbe SBO

A consortium led by Siparex has backed the tertiary buyout of French transport group Malherbe from Nixen Partners.

Smedvig exits SelStor to Pelican Self Storage

Smedvig Capital has sold Swedish self-storage company SelStor AB to Pelican Self Storage, which is operating in Copenhagen and Helsinki.

YFM exits Naylor Industries

YFM Equity Partners has sold UK-based manufacturer of building materials Naylor Industries back to its management, reaping a 2x money multiple on its original investment.

Doughty Hanson set to sell 20:20 Mobile Group

Doughty Hanson is in the process of selling mobile phone accessories business 20:20 Mobile Group to trade buyer Brightstar, according to reports.

Gresham exits 7city Learning

Gresham Private Equity has sold British financial training business 7city Learning to Fitch Group.

Unilever and FF&P exit BAC BV

Unilever Ventures and FF&P Private Equity have sold BAC BV, which specialises in affinity purification of biological materials, to Life Technologies Corporation.

Caledonia makes 3.5x on Celerant Consulting exit

Caledonia Investments has reaped a 3.5x money multiple on its exit from UK-based management consultancy business Celerant Consulting.

Alliance Entreprendre takes majority stake in Marline

Alliance Entreprendre is believed to have taken a majority stake in the SBO of French motor fuel producer Marline from Initiative & Finance.

Siparex and Somfy buy Sofilab

Siparex and Somfy Participations have taken a majority stake in Groupe Sofilab, a French producer of livestock watering troughs.

EdRip et al. support Groupe Marietton OBO

Edmond de Rothschild Investment Partners (EdRip), Crédit Agricole Régions Investissement and Siparex have backed the secondary owner buyout of French travel specialist Groupe Marietton.

Arle looking to sell Hilding Anders

Arle Capital Partners is considering a sale of Swedish mattress manufacturer Hilding Anders, according to reports.

Advent to sell shares in airport retailer Dufry

Advent International is understood to be looking to sell 3.9 million shares in listed Swiss airport retailer Dufry, a transaction that could be valued upwards of €350m.

EdRIP invests in secondary OBO of Itesa

Edmond de Rothschild Investment Partners (EdRIP) has taken a minority stake in the owner buyout of French security equipment distributor Itesa, allowing existing backer MBO Partners to exit the business.

Axa PE exits Phönix/Strack Group to Curtiss-Wright

Axa Private Equity has sold its entire stake in German specialist valves provider Phönix/Strack Group to the Curtiss-Wright Corporation for €82m.

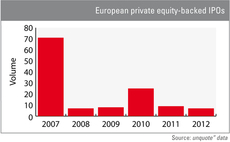

PE-backed IPOs few and far between in 2012

Moleskine might make headlines if and when it finally lists on the stock market later this year, but flotations remained a seldom-explored exit route for GPs in 2012, continuing a trend initiated in 2008.

East Capital exits Elko Grupa

Swedish investor East Capital has sold its stake in Latvian IT product wholesaler Elko Grupa to the company's existing shareholders, including investment fund Amber Trust.

3i finalises Norma Group exit

3i has sold its remaining 16.7% stake in listed German business Norma Group AG, bringing its total return to 5.5x.

VR Equitypartner and Bayern LB buy GHM Messtechnik from BPE

VR Equitypartner and Bayern LB Capital Partner have acquired German test and measurement equipment manufacturer GHM Messtechnik from BPE Unternehmensbeteiligungen for an estimated deal value of €50-100m.

Butler-backed Virgin Megastore files for insolvency

Virgin Megastore, a French retail chain backed by turnaround investor Butler Capital, has filed for insolvency.