Exits

Sovereign's World Class Learning to fetch >£150m

Buy-and-build specialist Sovereign Capital is a step closer to realising its 2008 investment in World Class Learning (WCL), a British exporter of educational services.

Investcorp acquires Hydrasun from Equistone

Investcorp has bought Aberdeen-based oil and gas services business Hydrasun Ltd in a secondary buyout from Equistone Partners Europe.

CapMan sells remaining shares in MQ

CapMan has sold its entire 28% stake in listed Swedish fashion retail chain MQ for SEK 16 per share, according to reports.

Permira and KKR sell €485m ProSiebenSat.1 stake

Permira and KKR have sold shares in jointly-owned German media giant ProSiebenSat.1 on the Frankfurt stock exchange for €485m.

Moscow Exchange IPO sets market cap at $4.2bn

Private equity-backed Moscow Exchange (MICEX) has set its IPO offer price at RUB 126.9bn ($4.2bn).

Private equity backers sell Rexel stake for €640m

Private equity backers including Clayton Dubilier & Rice and Eurazeo have sold a 14.7% stake in French listed electrical distributor Rexel for €640m.

Mercapital sells Lasem Group to management

Spanish GP Mercapital has sold its 41% stake in Catalan company Grupo Lasem, which operates in the baking and confectionery industry, according to reports.

CBPE sells Rosemont Pharmaceuticals to Perrigo

CBPE Capital has sold Leeds-based pharma company Rosemont Pharmaceuticals to US trade buyer Perrigo Company.

Palatine acquires Inspired Gaming unit

Palatine Private Equity has acquired the amusement and gaming division of British server-based gaming provider Inspired Gaming.

TIIN's ReadSpeaker completes management buy-back

TIIN Capital has sold its stake in Dutch software-as-a-service company ReadSpeaker back to the firm's management.

Lion Capital buys GHD from Montagu

Lion Capital has acquired UK-based professional hair styling brand GHD from Montagu Private Equity for an estimated ТЃ300m.

EQT exits BTX Group to Sun European Partners

EQT has agreed to sell Danish apparel company BTX Group to Sun European Partners.

Cobepa buys Socotec from Qualium

Investment holding Cobepa has acquired a majority stake in French management consulting firm Socotec from Qualium Investissement, alongside private equity investor Five Arrows and management.

Finding a way to exit the boom year deals

Many of the headline-hitting buyouts of the boom era are still sitting in private equity portfolios. Charles Magnay, partner at Altius Associates, looks at how GPs have adapted to exit large companies in the post-Lehman world.

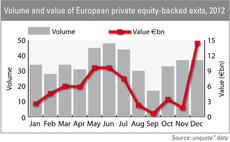

Exit market hits €15bn in December

Almost €15bn worth of capital was realised by private equity portfolio sales in December 2012, the highest amount in the past year, according to figures from unquote” data.

August sells 4Projects to TA-backed Coaxis

August has sold building software company 4Projects to US-based Viewpoint in a deal worth between ТЃ25-50m.

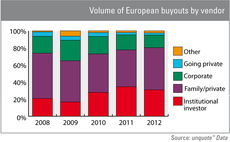

SBOs subside in 2012

Following a record 2011, the volume of “pass-the-parcel” deals abated slightly last year – but primary transactions still have a long way to go before returning to their pre-crisis glory.

Apax and LBO France to sell Maisons du Monde

Apax France- and LBO France-owned furniture stores chain Maisons du Monde is up for sale in a process run by investment banks Lazard and Messier Maris, according to reports.

International interest picks up in Central & Eastern Europe

European private equity was abuzz with exits paving the way for fundraisings last year, and CEE was no exception. Kimberly Romaine reports

N+1 buys Probos from Explorer

N+1 Private Equity has acquired Portuguese plastic band manufacturer Probos in a €75m SBO from Explorer.

Primary nets 5x on sale of Napier to Wabtec

Primary Capital has sold British turbochargers manufacturer Napier Turbochargers to US trade player Wabtec Corporation.

Halder exits Alukon

Halder Beteiligungsberatung has sold Alukon, a German manufacturer of aluminium roller shutters and door systems, to trade buyer Hörmann Group.

HgCapital exits RidgeWind to Blue Energy

HgCapital has sold its 177MW wind portfolio, including the developer RidgeWind, to UK-based renewable energy investor and developer Blue Energy for ТЃ250m.

Summit Partners sells Ogone to Ingenico for €360m

Summit Partners has exited Belgian payment solutions provider Ogone in a €360m trade sale to listed company Ingenico.