Exits

Further Global acquires majority stake in AA Ireland for €240m

AA Ireland posted тЌ13.7m in net profits in the year to January 2020 on sales of тЌ62.4m

Warburg Pincus sells stake in Avaloq at CHF 2bn valuation

GP invested in the banking software platform in 2017 at a CHF 1bn valuation and held a 45% stake

Norvestor exits Aptilo Networks to trade

GP exits the company nine years after acquiring it for тЌ14.5m

Nordic Capital, Carlyle bid for Octopus-backed Calastone

Trade bidders are also competing in the process, while Motive Partners was bidding, but is no longer involved

HTGF, WestTech sell Semknox to trade

Sale of its stake in the AI-backed product search software platform is HTGF's eighth exit of 2020

Keyhaven sells TCX to Investcorp's Dainese

Company becomes part of the Dainese group, which designs clothing for outdoor sports and is controlled by Investcorp

Main Capital sells RVC Medical to trade

Sale process saw interest from sponsors and corporates, and ends a six-year holding period for Main Capital

Livingbridge sells Mobysoft to ECI

Livingbridge began preparations to exit the company in July 2020, in a GCA Altium-led auction process

TDR-backed Buffalo Grill acquires distressed rival Courtepaille

Sale process was initiated by Courtepaille's PE sponsor Intermediate Capital Group, which filed for a receivership procedure in July

Mavenir buys VC-backed IP Access

Following the deal, IP Access will operate as a business unit within Mavenir's emerging business group

BC-backed Côte acquired by Partners Group

Former Wagamama CEO Jane Holbrook joins the French-style dining chain's board as chair

Italian PE players highlight silver linings amid crisis

Fundraising challenges, portfolio support and new opportunities were key themes discussed at last week’s Unquote Italian Private Equity Forum

Mayfair-, Hoxton-backed SuperAwesome sold to trade

SuperAwesome reported revenues of ТЃ21m in 2018, as well as an operating loss of ТЃ5.5m

DBAG partially realises investment in Pfaudler

Pfaudler's listed subsidiary, GMM Pfaudler, acquires an 80% stake in the business

VC-backed Snyk acquires BtoV portfolio company DeepCode

Cyber security software Snyk raised $200m at a $2.6bn valuation earlier in September 2020

UK deal pipeline: live, expected and pulled sale processes

A round-up of sale processes ongoing or expected to launch in the coming months in the UK, courtesy of Unquote sister publication Mergermarket

Hg sells A-Plan to trade buyer Howden

A-Plan was part of the portfolio of Hg 7, which closed on ТЃ2bn in April 2013

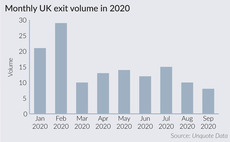

UK exits set to drag in Q3

Early figures from the third quarter suggest that very few GPs will be in sell mode for the rest of the year

Apax sells Neuraxpharm to Permira

Deal values the company at more than €1.6bn and is set to generate returns for Apax of 3.5x money

Polaris and AAC Capital exit BabySam to trade – report

GPs had reportedly been preparing to sell BabySam as early as 2017

DACH deal pipeline: live, expected and pulled sale processes

A round-up of sale processes ongoing or expected to launch in the coming months in DACH, courtesy of Unquote sister publication Mergermarket

Siparex, BPI France sell Duralex to trade

Firms invested in the business in 2015 alongside management, acquiring it from Initiative & Finance

Peak Rock acquires Halo Foods

Founded in 1980, Halo generated revenues of ТЃ35.2m in the year to 28 December 2019

French deal pipeline: live, expected and pulled sale processes

A round-up of sale processes ongoing or expected to launch in the coming months in France, courtesy of Unquote sister publication Mergermarket