UK exits set to drag in Q3

Following a dramatic drop in exit activity in Q2, early figures from the third quarter suggest that very few GPs will be in sell mode for the rest of year. Katharine Hidalgo reports

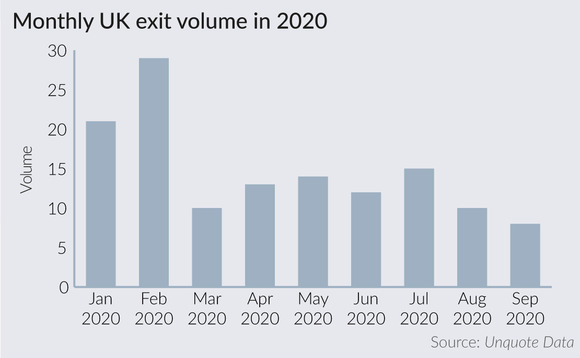

The UK saw 39 exits from buyout and venture investments in Q2, the lowest level since the second quarter of 1997, according to Unquote Data. As the private equity industry moves towards the end of Q3, the data suggests it will be just as weak a quarter.

July 2020 saw a slight uptick to 15 from 12 realisations in June, but August saw just 10 exits. While summer months often see muted activity, this still represents a significant decline on August 2019's 21 exits and August 2018's 18 deals.

We are not expecting to make any exits in 2020, but that can quickly change as there is an exciting tech market right now" – Haakon Overli, Dawn Capital

To date, eight exits have occurred in September 2020, compared with 13 exits in September 2019 and 19 in September 2018. These deals include Mobeus's sale of Blaze Signs to Elaghmore-backed Hexcite, and the sale of digital currency exchange Luno to Digital Currency Group. The latter saw Ariadne Capital, Balderton Capital and Venturra Capital exit the company.

VCs and GPs alike have shown caution surrounding potential exits. Dawn Capital general partner Haakon Overli says: "We are not in any major exit processes right now. As it stands, we are not expecting to make any exits in 2020, but that can quickly change as there is an exciting tech market right now. In general, companies need to achieve a certain revenue to be interesting and some need a little more time to get there. But strategic sales often happen earlier for 'deep-tech' assets."

Even among PE investors that are shifting away from a focus on portfolio management and are beginning to look at investments in the current environment, exit prospects are yet to match their appetite for acquisitions.

One such GP is FPE Capital. The firm recently went into exclusivity on a deal in the technology sector and is considering further investments; however, managing partner David Barbour says the firm is not expecting to make any exits soon.

Pause for thought

The drop in volume could be a symptom of wider uncertainty surrounding potential buyers. In August, Tenzing Private Equity managing partner Guy Gillon told Unquote: "We were initially contemplating some exits this summer and have had a lot of inbound interest, especially from PE-backed trade. However, in the current environment, I expect it will take six months to a year for those companies to rebound enough for that interest to become real again. We're not in a rush to sell and are happy to be patient capital."

Indeed, UK M&A activity in general took a dip in August 2020 to 40 acquisitions, down from more than 130 in March, according to Unquote sister publication Mergermarket. This suggests that appetite among trade buyers has dropped dramatically.

Price expectations are another stumbling block. Andrew Harrison, head of investor relations at Silverfleet Capital, says: "Those who are selling currently are unlikely to get away with the premiums being achieved prior to the crisis, except where a high-quality asset can demonstrate some resilience to the effects of the coronavirus crisis."

Proceed with caution

Realisations are unlikely to rise in the short-term, with the effects of the coronavirus continuing to wreak havoc on revenues for many PE-backed businesses, such as gyms, restaurants and tourism companies. With infection rates on the rise in the UK, further restrictions could once again level off consumer confidence and push some areas back into lockdown, limiting investors' ability to perform due diligence.

Nevertheless, a handful of GPs are tipped to brave the choppy waters as 2020 draws to a close. Among others, Carlyle and Palamon are preparing to sell their UK dental care portfolio company IDH Group, Mergermarket reported in August. The sale of the company, which operates UK dentistry chain MyDentist and dentistry supplier DD, could begin in Q4 2020, though no sell-side adviser has yet been appointed.

In addition, L Catterton-backed Sweaty Betty – a UK-based retailer of exercise wear – is in preparation for an auction. The asset could potentially fetch £400m, according to Bloomberg.

Meanwhile, some ongoing processes are showing signs of progress. Côte Restaurants sponsor BC Partners has entered negotiations to sell the UK-based French-style casual dining chain to Partners Group.

Direct investors Ontario Municipal Employees Retirement System and Ontario Teachers' Pension Plan are also selling their stakes in smart meter company MapleCo. Second bids for the asset are due on 21 September 2020, with DC Advisory advising on the process.

Click here for a rundown of the top ongoing, expected and shelved sale processes in the UK by Unquote sister publication Mergermarket

Some market participants are therefore cautiously optimistic. Paul Mann, a partner at Squire Patton Boggs, says: "We've seen more sale processes starting than there have been, and there is already a material difference in activity in recent weeks. I think there are certainly challenges, but I'm encouraged by activity in the market."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds