Deals

LGT sells Batisanté to IK Partners

New owner investing via Fund IX; looks to grow the company organically

Inflexion explores sale of Automotive Transformation Group

UK-based automotive software solutions provider is expected to be marketed off GBP 15m in a sale led by Houlihan Lokey

Main sells LOCATIQS to PE-backed Sogelink

Owned by Keensight, the combined group will have around EUR 120m revenues and will seek further acquisitions

Gramex Drinks sponsors in bilateral talks with strategic suitors

Owners ARX Equity and Structured Capital are evaluating offers against other options for developing the Hungarian soft drinks maker

Palatine backed-Veincentre stake for sale with Grant Thornton

Auction of UK-based clinic chain specialising in the treatment of varicose veins aims to attract a majority investor

IK pre-empts Batisanté sale at the start of second round

LGT-owned building hygiene and safety specialist attracted interest from several other financial sponsors

Oaktree exits Ascot Lloyd to Nordic Capital

New owner is acquiring the UK-based independent financial advisor via Nordic X

Soho Square launches auction for Technical Fire Safety Group

Sellside adviser Rothschild has distributed information memoranda to prospective buyers

Chequers weighs sale of textile chemicals maker Bozzetto

Sponsor will be advised by Lazard on the upcoming auction for the Italian producer of polymers and resins

Progressio exits Save the Duck to L'Occitane bosses

New owners pre-empted sale process for the Italian animal-free clothing brand; deals marks the second exit by Progressio’s Fund III

Inflexion acquires CDMO Upperton

The GP has invested in the British CDMO via its Enterprise Fund V

Volpi exits Version 1 to Partners Group

The Jefferies-led auction also saw Apax, OTTP, Cinven and Bain compete for the Irish IT solutions group

Verdane leads USD 190m growth round for Instabox

Sponsor will roll its stake in Porterbuddy, which was recently acquired by Instabox, and invest new capital in the Swedish e-commerce shipping group

Lonsdale buys infrastructure consultancy Infrata

Deal for London-based firm marks the second investment made outside the GPтs buyout fund, which closed investment period last year

GBL bags second healthcare asset this week with SBO of Sanoptis

Vendor Telemos to fully exit DACH eye clinics operator following auction that also saw ICG and Ares compete for the asset

KKR makes USD 15bn approach for Ramsay Health Care

European operations of Australia-listed hospital group account for EUR 760m EBITDA

Bowmark buys workflow automation provider WSD

GP will seek to expand London-based companyтs product development and grow in North America, Europe and Asia

Main sells Obi4wan to PE-backed Spotler

Exit to CNBB portfolio company Spotler Group ends a holding period of almost six years

GBL acquires Affidea from B-Flexion

Formerly known as Waypoint, vendor is fulling exiting the pan-European outpatient group; new owner will invest EUR 1bn in equity

The Bolt-Ons Digest – 19 April 2022

Triton's All4Labels; Committed's MR Marine; Goldman Sach's Advania; Main Capital's Perbility; and more

Investindustrial sells Neolith to CVC VIII

During Investindustrial tenure Neolith posted EUR 145m in revenues in 2021 and an EBITDA CAGR of approximately 20%

Buyout groups circle Trivium Packaging auction

Owners OTPP and Ardagh requested non-binding offers last week after distributing sale materials in March

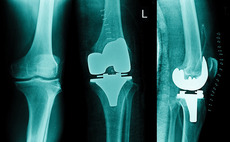

EQT pauses LimaCorporate auction

Sponsor is expected to reassess options for the Italian orthopaedic prosthetics producer after new CEO appointment

IK Partners sells Recocash to Qualium Investissement

Deal marks the third exit from IK Small Cap II, which is at least 93% deployed