Deals

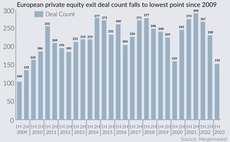

European SBOs sink to lowest level since GFC, leaving sponsors weighing exit options

Hopes for exits comeback pinned on M&A uptick and shift in valuation expectations in 2H 2023

RelyOn Nutec sponsor Polaris preps autumn sale via Houlihan Lokey

GP bought the safety training provider, then known as Falck Safety Services, in a carve-out in 2018

Cinven emerges as frontrunner for ICG's With Intelligence

ICG aims to sign deal for financial data and intelligence provider by end of next week

Stirling Square relaunches Outcomes First exit with education division sale

GP split the business into education and fostering units last year after an earlier sale attempt

Unquote Private Equity Podcast: Overcoming the exit impasse

Unquote assesses the obstacles to executing successful exits and speaks to Equistone senior partner Steve OтHare about the GPтs approach to its recent realisations

IK-backed Klingel bidder ELOS Medtech frontrunner in late-stage auction

German medical equipment firm also drew sponsor interest, with some dropping out due to valuation expectations

FPE Capital acquires, merges NoBlue and Elevate2

GPтs investment in NetSuite partners marks fifth investment out of third fund

Nordic Capital reaps around 6x money in Macrobond SBO

US-based tech sponsor Francisco Partners set to acquire the Swedish financial data provider

AlphaPet Ventures gears up to collect first-round bids as investors weigh up pet food's appeal

Sponsors including IK and TA Associates expected to look at Capiton-backed German petfood company

Macrobond owner Nordic Capital collects initial bids in wide sale process

Nordic Capital is expected to collect non-binding offers for Swedish financial data company Macrobond this week, two sources familiar with the situation said.

Summa Equity's Documaster tipped as likely exit candidate for 2024

GP bought a majority stake in Norway-based digital document platform provider in 2017

HLD's 52 Entertainment sale on hold over valuation issues

French gaming developer had been expected to see a valuation of at least 15x EBITDA

AnaCap exits GTT to Stirling Square

Vendor will reinvest in tax collection software for a 20% stake; buyer makes second tech deal in a month

Rovensa tipped for sale as PE owners weigh exit options

Bridgepoint and Partners Group have yet to decide on a process for the Portugese agriculture business

Palatine reaps 6x money on SBO of Anthesis to Carlyle

GP will be reinvesting in UK-headquartered sustainability firm, acquiring a minority stake

TSG's Bergfreunde hits the market in JPMorgan-led auction

Sale of German online clothing retailer follows performance spike during COVID-19 pandemic

Investcorp to take majority stake in PR firm SEC Newgate

USD 100m investment sees firm valued at USD 250m; existing shareholders including Three Hills will roll over their stakes

The Bolt-Ons Digest - 3 July 2023

Unquoteтs selection of the latest add-ons with Palatine's Anthesis, Nordic Capital's Regnology, Waterland's Janssen and more

Quadrivio rounds off Industry 4.0 Fund deployment with Twist acquisition

Acquisition of the Italian reconditioned tech hardware business is the last from the EUR 200m vehicle

Aenova sponsor BC Partners taps Jefferies to explore exit options

GP previously attempted to sell the pharma and healthcare CDMO in 2018, Mergermarket reported

Volpi raises EUR 250m continuation vehicle for 2016-vintage assets

Volpi Capital Investments Conti will hold Dutch geospatial data company Cyclomedia and UK-based surveillance group Digital Barriers

Advisors court Permira for Golden Goose stake sale as alternative to IPO

A slew of Italian and international banks are trying to get in front of Permira to help the Golden Goose Spa majority shareholder refine its thinking around exit options, three sources told Unquote sister publication Mergermarket, adding that some were...

Open GI owner Montagu kicks off sale through BofA, Arma

GP previously attempted to sell the insurance software firm in 2018, having acquired the company in 2014

ESI Group advances talks with buyout firms as strategic interest wanes

Binding offers for the listed French software firm are expected pre-European summer