Funds

MassMutual Ventures starts European deployment with USD 300m Fund III

New vehicle will focus on leading Series A rounds in digital health, fintech, enterprise SaaS, and cybersecurity

Elkstone Partners holds EUR 75m first close for start-up fund

Vehicle aims to reach EUR 100m hard-cap by November and will back up to 35 companies

Circularity Capital closes Fund II on extended EUR 215m hard-cap

New circular economy vehicle is 3x the size of predecessor with 80% of commitments from institutional investors

Ufenau closes Continuation III on EUR 563m

Swiss GP's new fund is backed by blue-chip secondary investors including StepStone and Five Arrows Secondary Opportunities

Cambridge Innovation Capital raises GBP 225m for Fund II

The VC firm's first closed-end fund will invest in Series A rounds of deep-tech and life science companies connected to Cambridge

Stirling Square gears up for fifth fund

Fund registration comes just over two years after the EUR 950m final close of Stirling Square IV

Western Balkans PE Fund gears up for debut vehicle first close

With a EUR 15m- EUR 20m close set for October, new SME-focused fund will now look to attract institutional investors from across Europe

17Capital closes debut Credit Fund on EUR 2.6bn

Fund is the GP's first to focus on NAV financing in the form of credit, rather than preferred equity

EQT sets Fund X hard-cap at EUR 21.5bn

GP is also on the road for funds including its EUR 4bn, impact-focused EQT Future Fund

Tilt Capital holds first close for debut energy transition fund

Co-founder Nicolas Piau speaks to Unquote about the GP's Siparex partnership. fundraise and strategy

Qualium III expects autumn final close

Vehicle will follow the investment strategy of its predecessor and has a EUR 500m target

Convent Capital holds first close for Agri Food Growth Fund

Growth capital vehicle will invest EUR 5m-EUR 20m per deal and has made its first investment

Getir backer Re-Pie launches EUR 70m VC fund

Re-Pie Ventures 1 plans to hold a first close by the end of 2022, general partner Mehmet Ali Ergin said

Melior Equity Partners holds EUR 160m final close for debut fund

Irish SME-focused GP is led by former Carlyle managing directors Jonathan Cosgrave and Peter Garvey

Inovexus gears up for seed investments in AI, blockchain, metaverse startups

Evergreen fund's LPs include Crédit Agricole, according to Inovexus CEO and founder Philippe Roche

MPEP holds EUR 215m interim close for fourth PE fund

GP expects to reach its EUR 300m target for Munich Private Equity Partners IV by summer 2022

Kempen reaches EUR 245m final close for second PE fund

Fund has made two co-investments and five partnership deals so far, Kempen's Sven Smeets told Unquote

JamJar closes second fund on GBP 100m

JamJar Fund II is the consumer technology-focused first fund with institutional investor backing

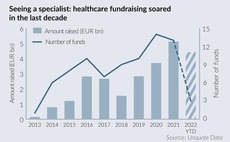

Specialist healthcare funds on track for another record year

GPs raised EUR 4.4bn with swelling need for healthcare investment but could face challenges in keeping a disciplined deployment

Access holds EUR 375m first close for ninth flagship fund

Managing partner Philippe Poggioli speaks to Unquote about the Access Capital Partners' small-cap buyout fund-of-funds strategy and the GP's latest fundraise

Nordwind reaches first close for debut technology fund

GP has been making technology investments deal-by-deal since 2012 and is now raising a EUR 160m fund

Ufenau VII closes on EUR 1bn hard-cap

Switzerland-based buy-and-build specialist plans to make 13-15 platform deals from the fund

Azalea holds USD 100m first close for sustainability fund-of-funds

Fund-of-funds will invest in managers focused on ESG and positive environmental and social impact

Growth Capital Partners V holds GBP 260m final close

UK-based GP aims to provide flexible capital for UK-based technology, services and industrials SMEs