Specialist healthcare funds on track for another record year

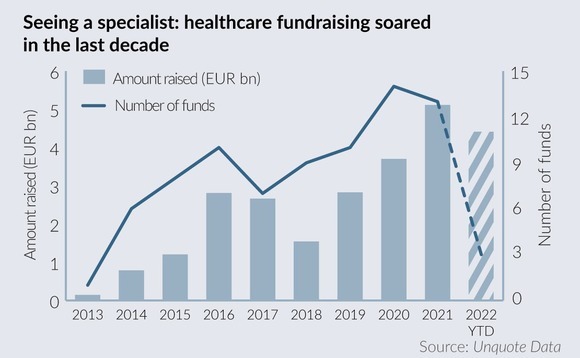

European healthcare specialist funds are on track for another record-breaking year with more than EUR 4.4bn raised in the first fourth months of 2022, Unquote Data shows.

With three fund closings announced so far this year and a slew of ongoing fundraising processes, these specialist funds could surpass last year's EUR 5.1bn record as managers benefit from a combination of heightened awareness for healthcare generated by the pandemic and a wider trend of LPs seeking specialised investors.

The bulk of this year's raise comes from KKR's closing of its second healthcare fund on USD 4bn (EUR 3.6bn), while another EUR 517m has been added by Gilde Healthcare's fourth buyout fund, with a further EUR 260m from Lauxera Growth I, a debut vehicle dedicated to health tech.

Ongoing fundraising processes include ArchiMed's recently launched second mid-cap fund, which it expects to be larger than its EUR 1bn predecessor, while Apposite Capital, CareVentures and Invivo Capital Partners have launched funds or held first closings.

The coronavirus pandemic, with its revelation of stark health inequalities and a big jump in public spending, has been pushing healthcare investment to the forefront of LPs' minds.

Fund managers are capitalising on the increased awareness with ever-larger amounts committed to trends like moving healthcare out of hospitals, precision medicine and other new technologies. LPs have been receptive to calls to re-up their commitments to these specialist funds: KKR's new fund is three times the size of its 2017 predecessor, while Gilde's doubled the size of its 2019 Fund III.

This jump in healthcare-specific funds has especially heightened over the past few years in Europe. In 2019, 10 specialist funds raised a collective EUR 2.8bn compared to EUR 5.1bn over 13 funds in 2021, according to Unquote Data.

Another factor contributing to the specialisation trend is driven by the maturity of assets and ongoing consolidation of various sectors like diagnostics, as well as the need for growth capital to back new technologies and therapies that improve health outcomes. Still, European managers might be just starting to catch up on a strategy that is quite established in the US.

"In the US in the past 10-15 years, investors have liked to invest in specialist private equity funds," Jasper van Gorp, managing partner at Gilde Healthcare, told Unquote. "In Europe, there are fewer specialist funds and many LPs like our healthcare specialisation, like our lower mid-market position."

While this year's fundraising has mostly been on the buyout side, historically the majority of healthcare funds have looked to raise growth capital, accounting for nine of the 13 funds closed in 2021. These include Sofinnova Capital X, which held a final close on EUR 472m; and Abingworth Bioventures VIII on USD 465m.

Impact angle

Both established funds and newcomers see specialisation as an advantage in a fundraising landscape flooded with managers looking for capital.

Well known GPs are joining the fray, for instance with EQT forming EQT Life Sciences through the acquisition of LSP 2021. Some newcomers like Vivalto Partners and Laurexa have hit the markets with debut funds focused on healthcare, with venture capitalists like Heal Capital as new joiners on the growth side.

As some generalist funds are struggling to gain LPs' attention, the healthcare specialist funds benefit from having an automatic impact angle. "One area seeing new money is impact investing, healthcare quite naturally falls into that category," said a partner at a small-mid cap UK-based private equity firm.

More dry powder inevitably leads to more deals, especially as generalist and infrastructure funds also continue to push into healthcare assets.

Since just the beginning of 2022, Carlyle and PAI teamed up to buy women's fertility asset Theramex for GBP 1.2bn, EQT's infrastructure funds acquired Aleris' radiology arm for EUR 286m, and Nordic Capital bought UK IVF business Care Fertility at a 16x EBITDA multiple.

The pipeline remains strong, with the ongoing auction of IVIRMA likely to top all those transactions. Offers for the Spanish fertility asset exceeded initial expectations, with KKR reportedly presenting a winning EUR 3bn bid last week. According to a source familiar with the situation, the second-placed bidder came in with a "substantially lower" offer.

Another record fundraising year for healthcare specialists will inevitably lead an M&A frenzy in the sector. The challenge for sponsors will be to stay disciplined in the deployment of ever-larger funds.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds