Venture

Purple Ventures plans EUR 30m-EUR 40m fund to invest across CEE

Early-stage investor expects to hold a EUR 20m-plus first close for its second fund by Q1 2024

Bewater Funds nears EUR 7m close for second fund, aims to back 20 companies in next four years

Bewater II FCRE takes minority stakes (5%-25%) with tickets of EUR 500,000-EUR 2m, and it has already made three investments.

Moonfire Ventures raises USD 115m to back early-stage startups in Europe

AI-powered VC firm has raised USD 90m for Fund II and USD 25m for its Opportunity Fund to double down on winners

Hamilton Lane targets global impact opportunities with new USD 370m fund

Asset managerтs new fund will make direct investments and can take larger stakes than its USD 95m predecessor

Bregal Milestone closes second tech fund on EUR 770m

European technology investor has around 60% dry powder remaining to deploy in its latest fund

Polestar Capital to raise up to EUR 500m for new e-mobility investment strategy

Dutch GP plans to close new vehicle in mid-2024 as Circular Debt fundraising continues

OTB Ventures heads for EUR 150m-plus final close of second fund next month

Deeptech-focused VC expects to make two to three more deals this year, Adam Niewinski said

Heran Partners nears full deployment of debut fund, mulls next fundraise

Health tech-focused VC is seeking three further software and hardware deals from EUR 75m debut vehicle

HV Capital doubles down on DACH investments with new EUR 710m early-stage and growth fund

Fund IX is the German VC and growth firmтs largest fundraise to date and will be split into two separate vehicles for venture and growth

Newly launched Utopia Capital aims to deploy EUR 10m-plus by 2028

Angel investor Christian Schroeder's new investment vehicle will support early-stage tech companies addressing humanitarian issues

VC Profile: HTGF optimistic on seed stage opportunities as exit environment toughens

German seed investor secured almost EUR 500m for its fourth and biggest fund to date at a time when VC funding is slowing down

4Impact heads for year-end close for EUR 125m second fund

Founded by ex-Goldman Sachs team, impact VC firm has made one investment from its latest fund so far

Forbion raises combined EUR 1.35bn for venture and growth funds

Ventures Fund VI closes on EUR 750m and Growth Opportunities II on EUR 600m with both upsized by over 60%

Gilde Healthcare hits EUR 600m target for Venture&Growth VI

Fund is 50% larger than predecessor thanks to “loyal” LP base; seeks late-stage deployment in medtech, digital health and therapeutics

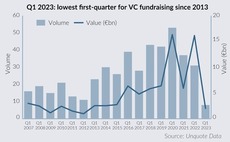

VC fundraising sinks further with lowest Q1 in a decade

Eight European firms secured just over EUR 2bn in commitments in Q1 2023 as continuing uncertainty suppresses LPsт risk appetite, but fundraising pipeline looks promising

VC Profile: Hi Inov in pre-marketing for next fund, outlines plans to wrap up Fund II investment period

France and Germany-based early-stage investor has made 15 of its up to 20 planned investments from its EUR 100m Fund II

Infravia aims to raise up to EUR 1bn for next growth fund, eyes mid-2024 launch

French sponsor expects to raise EUR 750m-EUR 1bn for B2B tech-focused second growth fund

EQT closes LSP Dementia on EUR 260m hard cap

Series A-focused fund exceeded its EUR 100m target and extended fundraising after increased LP interest in its strategy

Newton Biocapital heads for year-end close for second, EUR 150m life sciences fund

Belgian-Japanese VC has raised EUR 50m to date and is lining up exits from its debut fund

Sofinnova launches digital medicine strategy

Life sciences sponsorтs sixth strategy will deploy EUR 2m-EUR 8m tickets in seed and Series A

Nation 1 launches new early-stage, EUR 35m-EUR 40m fund

Czech investor targets first close in 1Q24, seeking to attract institutional investors and at least one bank

Beyond Impact aims for EUR 100m close for alternative protein fund

Article 9 fund held EUR 25m first close in early 2022; targets stakes in non-animal proteins and ingredients

Women in VC: Turenne Santé's Chaoui on new healthcare growth strategy and social impact

Healthcare sponsor aims to raise EUR 150m for new growth fund, with further deployment and fundraising for its LBO strategy in the pipeline

Nekko aims to reach EUR 10m hard-cap for N Venture I within six months

Spanish VC firm plans to build on the vehicle’s EUR 6m first close, with nine companies backed so far