Investments

Entry multiples heating up further in Q1 – research

Average value for PE-backed transactions increased by nearly 15% versus Q4 2018, says Clearwater

EQT, Summa, LGT sign up to UN's SDG Impact initiative

Development comes two months after EQT co-founder Ståhlberg left to launch an impact-dedicated firm

All eyes on venture as corporates and PE swoop in

Up to 17% of venture investments in 2018 saw the backing of an investor based outside Europe

Q1 Barometer: Price mismatch knocks dealflow

European buyout activity fell to its lowest point since Q1 2016 in the first quarter of 2019, but a large-cap rebound bolstered aggregate value

Buy-and-build drives consolidation in DACH

Last year saw the second highest volume of bolt-on deals in the DACH region in the post-2008 era

Buyouts soar but Dutch PE remains under scrutiny

NVP's recently released report highlights the buyout market's health, but the industry still faces renewed scrutiny around childcare investments

Unquote Private Equity Podcast: Karmic balance sheets

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team discusses recent developments in the impact investment space

Figuring out the ESG middle-ground

How can managers draft a policy that does not result in paralysis by over-analysis?

Smaller buyouts escalate in UK industrials sector

PE-backed buyout investments in both the industrial engineering and the construction and materials spaces have soared in the past year

French education deals offer a valuable lesson

Investment activity in the French education sector continues to look strong after a bumper 2018, with multiples heating up accordingly

Buy-and-build opportunities thrive in Italian market

In addition to the strong activity recorded on the buyout side, 2018 was also a busy year for Italy in the consolidation space

CEE venture ecosystem matures as buyout market stalls

With the buyout market at an inflexion point, the local venture capital scene could be the one grabbing headlines in the coming months

Concerning prognoses for German healthcare

Uncertainty around new regulation in the healthcare sector has caused jitters among investors

Bet the farm: reaping the rewards in agri-food investing

Investments in the agri-food tech space have bloomed in the past few years, while an increasing number of new players have entered the sector

PE success despite political headwinds in Belgium

Despite concerns related to political instability in the UK and at home, Belgium’s buyout market was in rude health last year

Q&A: Robert W Baird's Terry Huffine

Robert W Baird managing director Terry Huffine talks about the growing appetite for investment in the knitting and yarn industry

European VC catching up to US, says EIF's Grabenwarter

Panellists at the recent Invest Europe Investors' Forum in Geneva extolled the virtues of the European venture ecosystem

Annual Buyout Review: aggregate value reaches new peak

Unquote's lastest Annual Buyout Review, offering in-depth statistical analysis of European buyout activity in 2018, is now available to download

Comment: Is your data strategy offensive enough?

3i digital director Simon Andersen shares his insight on how companies and their PE backers can best leverage the growing amounts of available data

UK private equity anxiety as Brexit crisis intensifies

Twists and turns in the Brexit process are making it increasingly difficult for private equity practitioners to prepare for what lies ahead

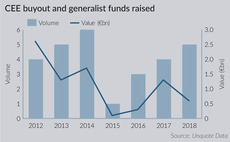

CEE fundraising activity promises buyout revival

Fundraising in the region held strong in 2018 in contrast to the rest of Europe and promises to be even stronger in 2019, even as dealflow slumped

Benelux trade deals surged in 2018

Exits to strategic buyers accounted for 56% of all divestments, with the volume of such deals increasing by 68% year-on-year

EC reduces charges for insurers in PE

Insurance companies accounted for just 8% of European private equity fundraising in 2017

Unquote Private Equity Podcast: European tour

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team examines the key takeaways from IPEM and SuperReturn