Investments

French cleantech attracts €1.22bn in 2018

Region sees value surge for renewable energy and circular economy deals, among others

Germany resists pan-European tech buyout decline

Drop in tech buyouts follows a pan-European trend, as every region besides southern Europe saw a decline

VC activity picks up steam in Spain

Venture capital activity maintained momentum in 2018, largely fueled by international players in later-stage rounds

Nordic GPs set their sights on the DACH region

Nordic buyout houses are increasing their presence in the region, both in terms of deal activity and boots on the ground

UK's financial sector buyout slump persists

Deal volume in the sector fell for the fifth consecutive year, with aggregate value falling for the fourth consecutive year

Nordic giants drive region's aggregate value jump

Aggregate value of buyouts in the Nordic countries jumped to тЌ25.7bn in 2018, a 66% increase on 2017

Unquote Private Equity Podcast: Crypto craze

Listen to the latest episode of the Unquote Private Equity Podcast, in which the team decodes the intricacies of securitised token offerings

Co-piloted investments prepared for take off

PE is displaying a growing willingness to invest in minority deals, with some GPs raising dedicated vehicles for the strategy

Large-cap deals turbo-boost Benelux buyout market

Deals valued at more than €500m reached a post-crisis peak last year, even setting aside Carlyle's €10bn AkzoNobel carve-out

Multiples Heatmap: winter cooldown across Europe

Latest Multiples Heatmap, published in association with Clearwater International, is now available to download

Strong LP appetite and creative credit to fuel DACH growth

Despite stiff competition for assets, PE firms in the DACH region hit record deal volume in 2018 and expect further growth in 2019

Tesi to invest €75m in circular economy initiatives

Tesiтs fund-of-funds programme makes 5-10 investments per year, totalling тЌ100-150m

Strong Italian dealflow boosts southern European activity

Italy reached an all-time peak in terms of buyout dealflow and aggregate value in 2018, boosting the region's figures as a whole

Q4 Barometer: European deal volume sets new annual record

Despite a slowdown in the final quarter of the year, private equity activity reached an all-time high over the course of the year

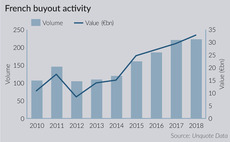

French buyout value climbs to post-crisis peak

Total deal value comfortably surpasses 2017's figure in a market driven by fierce competition, high prices and easy access to debt

Video: EIF's Panier talks fundraising, succession

Denise Ko Genovese interviews EIF's head of European lower-mid-market equity investments at the IPEM conference in Cannes

Video: Ambienta's Tronchetti Provera on sustainability trends

Greg Gille catches up with the Ambienta managing partner and founder at the IPEM conference

Unquote Private Equity Podcast: Minority report

Listen to the latest episode of the Unquote Private Equity Podcast, in which our Precogs envision PE's future of non-controlling stakes

AnaCap credit fund invests in €4bn loan portfolio

First investment from AnaCap Credit Opportunities Fund IV, which held a first close in November

Video: DN's Nenad Marovac talks venture success

Discussing DN's sweet spot, the rise of European unicorns, Brexit-related challenges, and more

Video: Eurazeo's Frappier on rising prices and keeping focused

Eurazeo Capital head discusses rising asset prices, international diversification, and the need for invesment discipline

Video: Capvis's Daniel Flaig on PE's 2019 challenges

Managing partner Daniel Flaig discusses how European GPs are responding to an increasingly competitive market and how he sees 2019 unfolding for PE

Video: Fireside chat with Silverfleet's Neil MacDougall

Denise Ko Genovese catches up with Silverfleet managing partner Neil MacDougall to discuss pricing and European opportunities

Unquote Private Equity Podcast: High-water marks and PE larks

Listen to the latest episode of the Unquote Private Equity Podcast, wherein the team discusses the 2019 Annual Buyout Review, Nordic PE's record year and more