Financing

Ares Management handed keys to two-thirds of UK sponsor's portfolio

Lender provided GBP 500m for three of the GP's deals between 2016 and 2019, Debtwire reported

Unquote Private Equity Podcast: Overcoming the exit impasse

Unquote assesses the obstacles to executing successful exits and speaks to Equistone senior partner Steve OтHare about the GPтs approach to its recent realisations

PE purchases stall in Italy as buyers lose faith – PE Forum Italy

PE players are hoping that valuation expectations will align in 2H 2023, easing dealmaking backlog

Portable refis pave way for smoother sponsor exits in rocky market

Sellers are aiming to bolster buyer confidence, securing debt that can be transferred to the next LBO

HSBC expects dealflow uptick and higher returns with second direct lending vintage

Second vintage expects to build on USD 580m in current commitments, with first deal expected in July

BlackRock buys growth and venture debt provider Kreos

Global asset manager plans to broaden Global Credit business with fresh acquisition

From slash-and-burn to grow-and-earn: private equity changes tack

Rising cost of capital means value-creation will be vital for next decade of private equity, SuperReturn participants said

Houlihan Lokey poaches Nielen Schuman's Theys to open up Antwerp office

Hire to cement Houlihan Lokey’s position in Belgium, which represents 30% of the advisor’s Benelux deals

European sponsors sidestep panic, concede gloom over bank woes

Fallout from Credit Suisse collapse adds to slew of macroeconomic challenges for PE dealmaking and fundraising

Constructive approach: PEs turn to bolt-ons amid exits and debt crunch

Buy-and-build strategies to take centre stage for sponsors faced with longer holding periods and tough market for platform investments

Adams Street launches private credit platform in Europe

Investor hires James Charalambides from Sixth Street to lead new strategy out of London

Adelis to sell Säkra in SBO to Cinven

Acquisition of Swedish insurance company marks fourth deal through GPтs Strategic Financials Fund

AnaCap could explore Wealthtime sale in 12 months

Sponsor formed the UK-based wealth management platform via a three-business merger

Morgan Stanley equity solutions MD departs

Gautier Martin-Regnier has left after nine years at the bank; expected to join sovereign wealth fund

Deutsche Bank head of EMEA equity-linked departs

Xavier Lagache is no longer in the role after more than a decade; replacement not announced

Pemberton strengthens team with four senior hires

Anders Svenningsen, Christoph Polomsky, James Taylor and Sally Tankard join the firmтs European offices

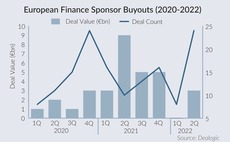

Sponsors brave the storm amid drop in financial services M&A

GP buyouts in the financial services space reached a two-year high in H1 2022 as rising financing costs and a brewing recession cloud the sector's M&A outlook

PE capital calls at 10-year low in 2021– Investec

Research cited the prevalence of fund financing and the increasing size of funds as reasons for the slow-down

Pemberton assesses European market for NAV strategy

Having hired Tom Doyle from 17Capital, the firm is looking at trends including generational change and market consolidation that will drive demand for strategy

17Capital promotes three to partner

David Wilson, Emad Shahin and Fokke Lucas join the firm's three existing managing partners

Pemberton launches NAV financing strategy with new hire

Thomas Doyle joins alternative credit specialist from 17Capital

GP Profile: 17Capital eyes buoyant NAV financing market

Unquote speaks to managing partner Pierre-Antoine de Selancy about the GP's strategy and market view

Oaktree and 17Capital announce strategic partnership

Oaktree is to take a majority stake in the London-headquartered specialised NAV financing provider

FSI buys 60% of Iccrea's digital payments arm at EUR 500m EV

Carve-out deal is the ninth investment from FSI I, which closed on EUR 1.4bn in February 2019 and is now 75% deployed