France

BPI launches €133m nuclear energy-focused fund

BPI France has officially launched its new fund, Fonds de Développement des Enterprises Nucléaires (FDEN), with €133m in capital.

EdRip's Cetal in OBO

Edmond de Rothschild Investment Partners (EdRip) has taken part in the owner buyout of its portfolio company Cetal, a French manufacturer of heating elements.

Argos Soditic promotes two in Paris office

Mid-market GP Argos Soditic has promoted Frédéric Quéru and Raphaël Bazin to investment manager positions in its Paris office.

Montagu acquires Rexam divisions for $805m

Montagu Private Equity has acquired the healthcare devices and prescription retail divisions of UK consumer packaging company Rexam for $805m in cash.

Cautious optimism in France as government unveils pro-business policies

New research by trade body Afic reveals improving sentiment among local GPs in the second half of last year – a positive trend likely to be further boosted by the government’s newfound social democrat leanings. Greg Gille reports

Ciclad buys Slat from Initiative & Finance

Ciclad has acquired French producer of electrical power supplies Slat in a secondary buyout from Initiative & Finance.

NCI acquires Thermes de Bagnoles de l'Ornes in SBO

NCI Gestion has acquired French spa operator Thermes de Bagnoles de l’Ornes (B’O Resort) from Acto Capital, marking the company’s tertiary buyout.

EdRip backs Groupe Gris

Edmond de Rothschild Investment Partners (EdRip) has invested in Groupe Gris, a French manufacturer of mechanical components, alongside historic backer ILP Sadepar.

TCR in SET Environnement MBO

TCR Capital has invested in the management buyout of SET Environnement, a French business specialising in asbestos removal.

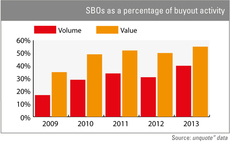

SBOs hit new peak in 2013

Secondary buyouts rose to new levels of prominence in the European market last year, accounting for 40% of all buyouts and 55% of aggregate buyout value. Greg Gille reports

Placement agents: a dying breed?

The placement agent industry has attracted criticism of late, with some labelling it as nothing more than a glorified introductory business. As fundraising becomes more complex, Alice Murray investigates how relevant this advisory service is

Partech et al. back Vodkaster

Partech Ventures, Elaia Partners and 3T Capital have injected €1.2m into Vodkaster, a French social media site for cinema.

Omnes divests Emalec in management buy-back

Omnes Capital has sold its stake in Emalec Développement, a French multi-site maintenance specialist, to the company’s management, which now has full control of the business.

Fintech: throwing down the gauntlet to financial services

Financial technology dealflow is growing at a steady pace and the banks are taking note. Amy King investigates the drivers and challenges behind the fintech revolution.

Insurers to ramp up private equity exposure in 2014

Insurers are rethinking their investment strategies and beginning to increase their exposure to private equity. Some are even looking at it from an asset-liability management perspective.

France's Access holds €190m first close for FoF

French funds-of-funds manager Access Capital Partners has held a first close on тЌ190m for its latest vehicle, Access Capital Fund VI Growth Buy-out Europe (ACF VI).

HarbourVest throws Motion lifeline

HarbourVest Partners has extended the life of Motion Equity Partnersт fund to enable it to exit portfolio companies.

Chequers acquires ISS division

Mid-cap GP Chequers Capital has acquired ISS Espaces Verts, the French landscaping division of EQT portfolio company ISS.

PAI reaches halfway line with €1.4bn first close

French private equity house PAI partners is understood to be halfway towards the hard-cap of its latest vehicle, PAI Europe VI.

XAnge and Isai back Evaneos

XAnge Private Equity and Isai have invested €4.4m in French travel firm Evaneos.

2013 buyouts: overall value stabilises around €75bn

The overall value of European private equity-backed buyouts has hovered around the тЌ75bn mark for the third year in a row, with last year's deals totalling тЌ74.7bn.