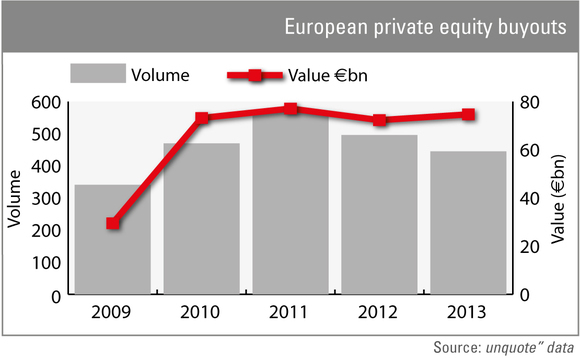

2013 buyouts: overall value stabilises around €75bn

The overall value of European private equity-backed buyouts has hovered around the тЌ75bn mark for the third year in a row, with last year's deals totalling тЌ74.7bn.

Based on preliminary figures from unquote" data, Europe was home to around 445 private equity-backed buyouts in 2013, which marks a 10% decrease compared to 2012. However, the overall value of these deals increased by a modest 3% to settle at €74.7bn.

This is the third year in a row that the overall value of European LBOs has hovered around the €75bn mark despite more significant variations in volume figures; overall value stood at €77bn in 2011 and €72.3bn last year.

Although small-cap dealflow (here meaning businesses valued in the < €50m range) took a step back in 2013 compared to the previous year, figures were much more encouraging in other market segments. The upper-mid-market (EV between €250-500m) was particularly buoyant, with dealflow increasing by 38% and overall value up by nearly 50%.

The €500m-1bn segment also posted impressive figures, with the overall value of these deals jumping by 35% to settle at €20bn. That said, mega-buyouts (€1bn+) were less in vogue last year, with both volume and overall value in this segment decreasing by around a quarter compared with 2012.

These figures are based on preliminary data from our proprietary database – look out for a more in-depth analysis of the European buyout market in the next unquote" Annual Review, out in the coming weeks.

All data is sourced from unquote" data, the unquote" proprietary database. To conduct your own searches on pan-European private equity trends, visit unquotedata.com

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds