Nordics

Open Ocean Capital backs Nordic Telecom

Finnish unified cloud communication provider Nordic Telecom (NTC) has raised $1.3m in a series-A funding from Open Ocean Capital.

Nordic unquote" December 2012/January 2013

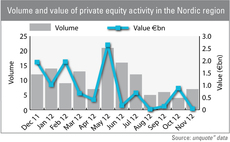

The Nordic private equity market т at one point seemingly impervious to the economic turmoil facing the rest of the world т has had a tough year.

Verdane reaps 6x on LensOn exit

Private equity-backed Prescription Eyewear has acquired LensOn, a Nordic online contact lenses seller backed by Verdane Capital.

Ratos in partial exit from Bisnode

Swedish business information firm Bisnode, a portfolio company of Ratos, has divested Baby DM Scandinavia.

Frozen Nordic market

In just two years, Sweden has lost half of its deal volume, showing that even the popular Nordics are not immune from Europe's economic drag.

ICG invests in Viking

Intermediate Capital Group has made a minority investment in Norwegian roadside assistance provider Viking Redningstjeneste.

HitecVision sells Spring Energy Norway to Tullow Oil

HitecVision has sold its 87.6% stake in Spring Energy Norway to London-based exploration company Tullow Oil for approximately $326m.

Fundraising gets personal

Fundraising gets personal

Industrifonden et al. invest in Avtal24

Industrifonden along with private investors Richard BУЅge, Magnus Wilkne, among others, are investing SEK 10m in Swedish online legal services provider Avtal24.

Verdane exits TeamTec to IMS

Verdane Capital has reaped a 4x multiple on the sale of its entire stake in Norwegian shipping company TeamTec Invest to local steel manufacturer Industri & Montasjeservice AS (IMS).

EQT exits Gambro to Baxter

EQT and Investor AB have sold the remaining division of Swedish healthcare business Gambro Group to trade player Baxter International for SEK 26.5bn.

Reiten exits Basefarm to ABRY

Nordic private equity firm Reiten & Co has sold Norwegian IT company Basefarm to US-based ABRY Partners.

Catella increases stake in IPM

Catella AB has increased its stake in investment services firm IPM Informed Portfolio Management AB from approximately 5% to 25% through a SEK 33m new issue private placement, conditional on an approved ownership assessment.

Nordic PE investment fell in Q3

Private equity funds invested around тЌ1.1bn in the Nordics in the third quarter, тЌ750m less than in Q2, according to the Argentum Q3 2012 Report. The figures paint Q3 as the trough for the region this year.

Ratos sells Contex to Procuritas for $41.5m

Ratosтs portfolio company Contex Group has signed an agreement to sell Danish Contex AS to the private equity fund Procuritas Capital Investor V LP for a total of $41.5m.

Nordic Capital refinances Orc with €60m bond issue

Orc Group, a Swedish financial technology and services provider owned by Nordic Capital, has placed a five-year тЌ60m senior secured high-yield bond.

Norrlandsfonden refinances Mackmyra

Norrlandsfonden has extended its convertible debt facility for Swedish whisky distillery Mackmyra Svensk Whisky AB for another five-year period.

NTC Holdings further reduces stake in TDC

The holding jointly owned by Apax, Blackstone, KKR, Permira and Providence has sold 80 million shares in Danish telecommunications company TDC.

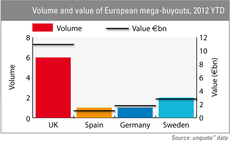

UK mega-buyouts worth more than €10bn this year

In defiance of problems on the continent, the UK has seen a surge in mega-buyouts this year, topped off with the recent acquisition of Annington Homes for ТЃ3.2bn.

Herkules Capital's Pronova BioPharma receives takeover bid

Herkules Capital's Norwegian portfolio company Pronova BioPharma has received a voluntary cash offer from German chemicals company BASF SE.

KIC InnoEnergy and Sting join forces

Sting (Stockholm Innovation and Growth) is teaming up with KIC InnoEnergy Sweden to offer development support to Stockholm-based start-ups within the renewable energy sector.

CapMan Buyout X holds first close

CapMan Buyout X has held a first close at тЌ152m.

Inventure leads €1.2m series-B round for Miradore

Inventure and Belgian ICR executive Willem Hendrickx have invested тЌ1.2m in Finish IT platform provider Miradore.

HitecVision hires senior partner

Norwegian GP HitecVision has hired Alf Thorkildsen as senior partner.