Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

BIP management presentations ongoing, with strong PE interest

Apax acquired a 60% stake in the business from private equity firm Argos Wityu in early 2018

Nordic Fundraising Pipeline - Q1 2021

Unquote rounds up notable fundraises ongoing across the Nordic market, including EQT, Axcel, CapMan, Saga, and more

Lonsdale backs Horseware Ireland

This is the ninth investment made by the GP via Lonsdale Capital Partners Fund I, which closed on ТЃ110m in 2016

Procuritas to net 8x on Pierce IPO

GP acquired the online motorcycle parts and accessories retailer in 2014

Aksia buys Medical International Research

GP invests in the company via Aksia Capital V, which targets European businesses with potential for high-growth

VCs in $290m round for grocery delivery platform Gorillas

Grocery delivery startup claims to reach customers in 10 minutes and is reportedly valued at $1bn

Investindustrial launches takeover for Guala

Minority shareholders GCL Holding and Peninsula Capital might try to block the takeover

Semantix owner Segulah preps exit with William Blair

Semantix was originally established in 1969 and was acquired by Segulah in 2015

H2 Equity readies Brink exit with Houlihan Lokey

Brink will be marketed based on EBITDA of more than €25m, according to one source

Cairngorm eyes £200m final close in July

Fund's predecessor, Cairngorm Capital Partners II, reached a final close on ТЃ107.5m in April 2017

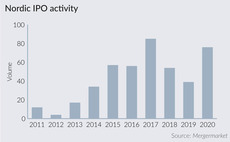

Nordic IPO rush drives exit opportunities for GPs

Wave of Nordic IPOs shows no signs of receding this year, often driven by new opportunities emerging from the pandemic

Armada Credit Partners closes fifth fund on €210m

Fund V is already 50% deployed and has made seven investments so far

TDR Capital acquires BPP from Apollo's Vanta Education

Vocational course provider BPP was acquired by Vanta Education in 2009, prior to Apollo's investment

Vallis sells Imperial to trade

Sale ends a six-year investment period for Vallis, which invested in the business via Vallis Sustainable Investments I

Graphite Capital invests in Higher Ed International

GP is acquiring a minority stake in the online education provider via Graphite Capital Partners IX

Hg acquires Trackunit from Goldman Sachs, Gro Capital

Sale comes nearly six years after the GPs acquired the company

Quadrivio buys Dondup from L Catterton

GP backs the company via Made in Italy Fund, which invests in Italian businesses operating in the fashion, design and food industries

GCP secures minority stake in Bridewell Consulting

Deal is the first investment for Growth Capital Partners Fund V, which was registered in Q3 last year

UK & Ireland Fundraising Pipeline - Q1 2021

Unquote rounds up the most notable fundraises currently ongoing in the UK & Ireland market across the buyout, venture and debt spaces

Capital Dynamics Global Secondaries V closes on $786m

Fund invests in a diversified portfolio of global secondaries interests in mid-market private equity funds

Klar Partners closes debut fund on €600m hard-cap

GP started raising the fund in March 2020 and said the vehicle was "significantly oversubscribed"

Hg sells Trace One to Symphony Technology Group

Hg invested in the retail and branding management software in 2016 via HgCapital Mercury Fund

Activa sells Active Assurances to Silver Lake's Meilleurtaux

Sale ends a three-year holding period for Activa, which invested in Active Assurances alongside BPI France

Nordic Capital acquires minority stake in Leo Pharma

GP's stake is reportedly smaller than 25%, with the current owner remaining as the majority shareholder