Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

Sovereign appoints Bergvall as investment manager

Sovereign Capital has appointed former Duke Street deal originator Monica Bergvall as an investment manager in its direct origination team.

Countrywide's IPO pricing at top of range

Private equity-backed estate agent Countrywide has narrowed its IPO pricing at the upper end of its range.

LDC backs NRS Healthcare MBO

LDC has taken a stake in the ТЃ24m management buyout of NRS Healthcare, the healthcare division of listed multi-channel retailer Findel plc.

Apax France sells Numericable B&L and Cabovisao stakes

Apax France has agreed to sell its stakes in cable operators Numericable Belgium/Luxembourg and Cabovisao to co-owner Altice.

Arlington backs MB Aerospace MBO

Arlington Capital Partners has backed the secondary management buyout of UK- and US-based aerospace engineering group MB Aerospace from LDC.

Ratos and Bonnier merge SF Bio with Finnkino

Ratos and Bonnier AB have agreed to merge SF Bio and Finnkino Oy, a deal designed to form the Nordic region's largest cinema group.

Mobeus backs Gro Group MBO

Mobeus Equity Partners has invested in the management buyout of nursery brand Gro Group.

Patron et al. in Cala Group bolt-on

Patron Capital Partners and Legal & General Group have agreed to acquire UK-based home builder Cala Group Ltd for ТЃ210m.

b-to-v Partners leads funding for ondeso

b-to-v Partners has led a funding round for German IT security company ondeso, which also saw commitments from existing investors Bayern Kapital and High-Tech Gründerfonds (HTGF).

Syntegra's Moleskine launches IPO

Syntegra Capital has launched the IPO of portfolio company Moleskine in a listing that could value the business at up to €530m.

Marks & Spencer circled by Qatar-led consortium

Iconic British retailer Marks & Spencer could be the target of an ТЃ8bn takeover by a Qatar Investment Authority-led consortium, which could also include private equity players such as CVC, according to reports.

Greencoat Capital leads £6.75m round for Aveillant

Greencoat Capital has led a ТЃ6.75m funding round for UK-based radar technology developer Aveillant.

PE-backed Hofmann bolts on Posterjack

Hofmann, a Spanish photo album specialist backed by Realza Capital and Portobello Capital, has acquired German customised printing company Posterjack.

LitCapital et al. back Baltic Bicycle Trade

LitCapital and German firm Panther International have invested $1.8m in Lithuania-based electric bicycle company Baltic Bicycle Trade.

Highgrowth sells Facomsa stake to Prudential Tradelink

Spanish VC investor Highgrowth has sold its 35% stake in automotive components manufacturer Facomsa in a trade sale to Prudential Tradelink.

Calls for calm over BoE private equity report

Private equity professionals should not panic over the latest Bank of England report on the private equity sector, according to the ICAEW.

BNP Paribas et al. invest in Systar

Systar, a French provider of operational intelligence software, has completed a €2.35m private equity offering.

Iris Capital and Capnamic Ventures join forces

Iris Capital and Capnamic Ventures have entered into a partnership agreement to make early-stage investments in Germany.

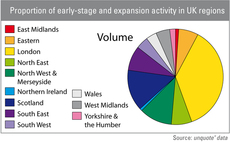

London & Scotland see most growth investment

In 2012, the UKтs venture and growth capital scene was once again most active in London, where unquoteт data recorded 82 transactions with a combined value of ТЃ734m.

NVM exits Interlube Systems in trade sale

NVM Private Equity has sold British automated lubrication producer Interlube Systems to a subsidiary of The Timken Company, reaping a money multiple of 3x.

Moulton predicts 10x increase in dealflow

Q&A: Jon Moulton

3i and RCP exit Giraffe to Tesco

3i and Risk Capital Partners (RCP) have sold their 36.8% stakes in UK-based restaurant chain Giraffe to Tesco, giving the business a ТЃ48.6m enterprise value.

HTGF, eCapital et al. invest €3.3m in Saperatec

A consortium led by eCapital entrepreneurial Partners and including High-Tech Gründerfonds (HTGF), Gründerfonds Bielefeld-Ostwestfalen, NRW Bank and a business angel, has invested €3.3m in German recycling business Saperatec.

Latour Capital buys Oxand

Latour Capital has taken a majority stake in the buyout of Oxand, a French engineering and consulting firm specialised in the risk-based management of industrial infrastructure.