Region

Unquote has a long history of delivering in-depth coverage for each European market, from individual deals to fundraising and region-specific trend analysis. Click on the following links to access content for a specific region:

UK & Ireland DACH Nordic France Southern Europe Benelux CEE

GCP backs Scopus Engineering with £13m

Growth Capital Partners (GCP) has invested ТЃ13m in Scopus Engineering, a Scottish provider of laser survey services to the global oil & gas industry.

Endless reaps 6x on Acenta Steel exit

Endless has sold its stake in UK-based steel bars processor Acenta Steel to the company's management, reaping a return of 6x its original investment.

EdRip and BNP Paribas to back RBI spinout

Edmond de Rothschild Investment Partners (EdRip) and BNP Paribas Développement have entered exclusive negotiations to back the management buyout of French media group Reed Business Information (RBI) from its parent company Reed Elsevier.

unquote" Regional Mid-market Barometer

A rise in alternative lenders and a strong trade buyer presence helped drive the UKтs mid-market in 2012, according to the latest unquoteт Regional Mid-market Barometer, published in association with LDC.

NorthEdge Capital appoints investment manager

NorthEdge Capital has appointed Tom Rowley as an investment manager in its Leeds office.

RJD's Harrington Brooks acquires customer books in bolt-on

RJD Partners portfolio company Harrington Brooks has acquired customer books from Carrington Dean and The Nostrum Group, marking the company's first expansion following its secondary buyout in July 2012.

GSK plans Lucozade and Ribena sale

Pharmaceutical group GlaxoSmithKline (GSK) has put soft drinks brands Lucozade and Ribena up for sale, giving rise to a bidding war in excess of ТЃ1bn, according to reports.

Vendis backs Alexandre de Paris

Vendis Capital Management has taken a stake in the buyout of French hairdressing salon and cosmetics company Alexandre de Paris, in what marks the GP's first investment in France.

Maven launches £5m top up offer for VCTs

Maven Capital Partners has launched a ТЃ5m top-up offer for Maven Income and Growth VCT 4.

Fouriertransform backs TitanX

State-owned venture capital firm Fouriertransform AB has agreed to invest SEK 185m in Swedish automotive company TitanX Engine Cooling, which is also backed by EQT.

Maven sells Homelux to QEP Company

Maven Capital Partners has sold tile accessories business Homelux to US firm QEP Company, following its carve-out from UK-based Homelux Nenplas Ltd.

Omnes et al. in €10m round for EyeTechCare

Returning backer Omnes Capital has taken part in a €10m series-C round of funding for French medical devices developer EyeTechCare.

Finance Wales backs Safety Technology

Finance Wales has provided Monmouthshire-based safety specialist Safety Technology with a six-figure loan.

LDC backs Fever-Tree

LDC has taken a 25% stake in Fever-Tree, valuing the UK tonic water and mixers brand at ТЃ48m.

Oxford Capital exits Arieso to JDSU

Oxford Capital Partners has sold UK-based mobile network optimisation specialist Arieso to Nasdaq-listed JDSU in a $85m deal.

CVC sells further shares in Evonik ahead of IPO

CVC and Rag Foundation have sold a further 4.6% stake in German chemicals business Evonik, reducing their stakes by around 6% each in total, ahead of a renewed attempt at listing the business.

Iberian private equity: special report

Enthusiasm for Iberian markets has returned lately, with some international investors in the audience of a recent industry conference citing Spain as the most attractive target for private equity. The government’s structural reforms have reassured GPs...

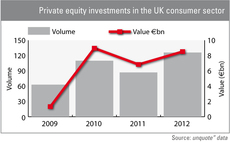

UK consumer sector: private equity dealflow up 45% in 2012

High street woes notwithstanding, the UK consumer sector proved to be ripe for investment opportunities last year: private equity dealflow was up by 45% compared to 2011 figures while the overall value of these investments rose by a quarter.

LGV Capital to wind down portfolio

Insurer Legal & General has confirmed its private equity arm LGV Capital will stop making new investments, and will instead focus on managing and eventually divesting its existing portfolio.

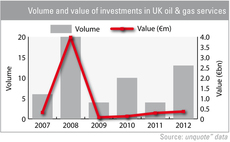

Private equity to benefit from oil & gas boom

The high price of oil could provide a boom to many operating in the oil & gas sector in the UK, and private equity players are looking to take advantage of the opportunities it offers.

Gimv's Verbinnen winds up

Gimv-backed Belgian food processing business Verbinnen Poultry Group has filed a petition to wind up on 25 February 2013 after failing to find a buyer.

Ingenious Ventures joins forces with BBH's Zag

Ingenious Ventures is teaming up with Zag, the corporate venturing arm of global advertising agency BBH, to invest in the British creative industry.

Equistone seals Brétèche Industrie deal

Equistone has completed the acquisition of a majority stake in French food machinery business Groupe Brétèche from Azulis Capital and Unigrains.

Investor AB backs Active Biotech with SEK 270m

Investor AB has agreed to buy six million newly-issued shares in Active Biotech, providing the company with SEK 270m in total after transaction costs.