UK / Ireland

LDC backs GBP 65m MBO of Texecom

LDC buys the provider of intruder alarm systems from its listed parent Halma

The Deals Pipeline

A highlight of deal processes underway and involving PE, either on the buy- or sell-side, across Europe

Video: Q&A with Rutland Partners' David Wardrop

David Wardrop joins Unquote editor Greg Gille to discuss how the firm is approaching the post-Covid investment landscape

Morrisons adjourns shareholders' meeting, CD&R still looking at offer

Clayton Dubilier & Rice has asked that it be provided with more time to consider its options

Lonsdale scores fourth exit of 2021 with Cross Rental Services sale

Sale of CRS is the GP's seventh exit since inception, and its fourth this year

Tenzing nets 5.6x on exit of Smoothwall

Second exit for the firm's debut fund, after reaping a 72% IRR on FMP Global

Pamplona to acquire Pelsis from LDC

LDC backed the management buyout of Pelsis from US-based GP Wind Point Partners in 2017

Secondaries activity rebounds to record USD 55bn in H1 – survey

Direct secondaries account for the majority of transactions for the first time ever, says Setter Capital

Bridges reaps 2.5x return on sale of Wholebake to Elysian

Deal is the second investment for Elysian Capital III, which closed on its GBP 325m hard-cap in 2020

SVPGlobal closes SVSS V at USD 5bn hard-cap

SVSS V closes three months following its first close, and exceeds its USD 2.85bn predecessor

KKR hires new director in London

Michaela Wood joins KKR after six years at CVC Capital Partners

TriSpan buys Pho, Gresham House Ventures exits

Pho generated revenues of around GBP 40m in the year to February 2020

TA buys Smiths Medical from parent Smiths Group

Deal gives the medical subsidiary a USD 2.3bn enterprise value

Houlihan Lokey to buy GCA

GCA Altium and GCA’s US business will operate under the Houlihan Lokey brand

Sanne board to recommend Apex offer

Should Apex make a firm offer, Cinven would have to significantly up its own bid for the fund administrator

Lonsdale sells Charles Cameron to Penta's Socium Group

Third exit announced by Lonsdale this year, and the second from its 2016 fund

Mayfair backs Tangle Teezer MBO

Report by The Times values the business at more than GBP 200m

Livingbridge acquires IT service North from Aliter Capital

Aliter Capital formed North via a buy-and-build strategy for portfolio company Boston Networks

Bregal Milestone to launch second fund

European growth technology investor held a final close for its debut vehicle in 2018 on EUR 400m

Wm Morrison shareholder JO Hambro to decline Fortress takeover offer

JO Hambro say the offer is below the 270p level that would be worthy of consideration

Novalpina to lose control of EUR 1bn debut fund

GP was founded in 2017 and is notably invested in Israeli spyware business NSO Group

ICG takes EUR 1.45bn ESG-linked facility for Europe VIII

Standard Chartered Bank was coordinator and mandated lead arranger on the facility

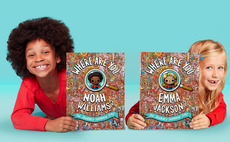

Graphite Capital acquires Wonderbly

Personalised children's books publisher is the seventh deal from Graphite's 2018-vintage ninth fund

Permira registers eighth flagship fund

GP could be aiming for more than USD 15bn, up from EUR 11bn for Permira VII, according to an earlier report