Healthcare

Inflexion acquires CDMO Upperton

The GP has invested in the British CDMO via its Enterprise Fund V

GBL bags second healthcare asset this week with SBO of Sanoptis

Vendor Telemos to fully exit DACH eye clinics operator following auction that also saw ICG and Ares compete for the asset

KKR makes USD 15bn approach for Ramsay Health Care

European operations of Australia-listed hospital group account for EUR 760m EBITDA

GBL acquires Affidea from B-Flexion

Formerly known as Waypoint, vendor is fulling exiting the pan-European outpatient group; new owner will invest EUR 1bn in equity

EQT pauses LimaCorporate auction

Sponsor is expected to reassess options for the Italian orthopaedic prosthetics producer after new CEO appointment

ICG, Ares and GBL among sponsors in Sanoptis second round

Current backer Telemos wants to remain invested as a minority shareholder in the ophthalmology group

Carlyle acquires life sciences investor Abingworth

Deal follows EQT's acquisition of LSP in November 2021 as asset managers look for greater specialisation

EMZ acquires FotoFinder Systems

EMZ is acquiring a majority stake in the medical imaging company via EMZ 9, which is 80% deployed

Bridgepoint in exclusivity to acquire G Square's Dentego

Mergermarket reported that sponsors including Ardian, BC, Eurazeo and IK showed interest in the asset

Novo-backed ReViral acquired by Pfizer

The British biotech company is also backed by CR-CP, New Leaf, Andera Partners, and OrbiMed, among others

Dental Directory sees Exponent, Equistone bare teeth in sale second round

DC Advisory is expected to review final bids for the carve-out from Palamon-backed IDH Group in about a month

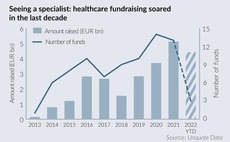

Specialist healthcare funds on track for another record year

GPs raised EUR 4.4bn with swelling need for healthcare investment but could face challenges in keeping a disciplined deployment

AP Moller, Biogroup among final bidders for Waypoint's Affidea

Final offers for the pan-European outpatient group are expected in a couple of weeks

Lightrock announces promotions, board appointments

Impact investor expects to turn its focus to new deals in 2022 and grew its team by 30% in 2021

Summit buys 18 Week Support

Deal for UK-based NHS insourcer confirmed by March 25 Companies House filing; buyout follows Houlihan Lokey-led auction launched last year

CVC sells Theramex to Carlyle, PAI for GBP 1.2bn

CVC acquired the women's health pharmaceutical business in a USD 703m carve-out in 2017

Ardian readies Dedalus for controlling stake sale

Morgan Stanley and UBS are preparing an auction for the Italy-based hospital software group

GHO to explore Sterling Pharma exit this year

UK pharma manufacturing services asset could be marketed off GBP 50m EBITDA in a sale process in H2 2022

Hg gears up for MEDIFOX DAN exit

Houlihan Lokey will advise on the sale of the healthcare software group, which has already seen interest from large sponsors

Jeito, INKEF, Forbion lead EUR 80m Series B for Precirix

Precirix last raised a EUR 37m Series A in 2018

Gilde Healthcare closes fourth buyout fund on EUR 517m

Double the size of its predecessor, the new vehicle was oversubscribed and saw nearly all Gildeтs existing LPs investing

I Asset Management, BaltCap acquire Dr Vet

IAM has a specialist Petcare Growth Fund

Ufenau moves Corius and Altano to continuation fund

Bought in 2017, the dermatology and vet groups have been transferred into the Swiss GP’s third continuation vehicle

Queen's Park Equity backs Blue Ribbon MBO

The deal is the sixth from QPE's Equity Fund I