Healthcare

IK and Carlyle sell Marle to Dentressangle

GPs to sell stakes in the manufacturer of orthopaedic implants to family investment holding company Dentressangle

Ardian's Neopharmed buys pharma company MDM

Neopharmed Gentili intends to consolidate its market position and expand its product offering

Advent-backed Zentiva acquires Alvogen

Transaction is expected to close in the first quarter of 2020, subject to customary approvals

Adiuva acquires Fachklinik St Georg

Infrastructure investor Captiva has agreed to acquire the clinic's 6,000m2 of rental space

VC-backed DocPlanner buys TuoTempo

TuoTempo will operate independently and CEO Bianco will stay on with the business

Lux, Obvious Ventures lead €11.5m series-A for LabGenius

Fresh capital will be used to initiate an internal asset development programme

Benelux biotech and pharma startups attracting larger rounds

Average tickets for early-stage investments have jumped from €13m in 2017, to €20m the year after and €36m this year

Waterland-backed Schönes Leben acquires Mediko

Waterland began its care home buy-and-build strategy in 2017 with the acquisition of Compassio

PE-backed GTX Medical merges with US peer

Dutch medtech business GTX has merged with US counterpart NeuroRecovery Technologies

Pantheon to invest in KD Pharma in single-asset restructuring

Capiton IV has sold a stake in its portfolio company, Omega-3 producer KD Pharma

FSI buys minority stake in biopharma company Kedrion

GP invests via its FSI I fund, which held a final close on €1.4bn in March 2019

Atomico leads $56m round for Healx

New investors Global Brain, B-to-V and Intel Capital have invested in the biotechnology company

Synova inks first deal from latest fund with Preventx

Preventx is a provider of online-led sexual health testing and diagnostic services

Looking for the digital health tonic

Massive recent uptick in investment means 2019 is expected to reach an all-time high for digital health

BIVF, Gründerfonds Ruhr lead €12m series-A round for Abalos

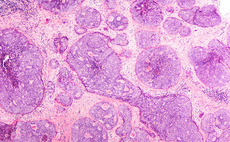

Abalos Therapeutics is a biotechnology company focused on developing immuno-oncology therapeutics

Nordic Capital's Acino acquires Takeda's primary care portfolio

Coller Capital and Goldman Sachs acquired a stake in Acino in 2018 in a GP-led secondary transaction

Ahren et al. in $16m round for Mogrify

Biotech's series-A is supported by a consortium of investors led by existing backer Ahren

Aksìa buys dental group Primo from Archimed

Sale ends a four-year holding period for French GP Archimed, which owned a 48% stake in the firm

VCs in £27m series-A for MiroBio

Advent Life Sciences, SR One, Oxford Science Innovation and Samsara Biocapital have invested

Ardian-backed Riemser buys Zaltan

Zaltan will be fully integrated in the Riemser group and operate under the name Riemser Iberia

Principia backs laser specialist Lambda

Company management retains the remaining minority holding and stays on with the business

Advent buys Industria Chimica Emiliana

GP intends to further strengthen the company's market position and boost its international expansion

VC firms back €20m series-A for Stipe

Novo Holdings co-leads the round with Arix and Wellington Partners, and Sunstone Ventures invest

Omnes leads €8.4m funding round for Newronika

Previous backers Indaco Venture Partners and Innogest also take part in the round alongside F3F