Healthcare

Principia backs CrestOptics

VC firm deployed capital from its healthcare-dedicated vehicle Principia III – Health

Sofinnova and 5AM lead £28m series-A for NodThera

UK drug discovery company will bring its leading drug candidate to the clinical trial stage

Ergon Capital buys Indo in SBO

Sale ends a five-year holding period for Sherpa, which acquired the company after it hit bankruptcy

HTGF sells Sierra Sensors to trade

Sale ends a 12-year holding period for HTGF, which invested in the business from its first fund

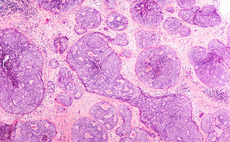

MPM et al. in €64m series-B for iTeos Therapeutics

Previous and new backers inject €64m in the cancer-focused biotechnology company

CVC in talks over acquisition of Recordati

Talks were put on hold recently due to concerns about Italy's political uncertainty

PE-backed SGH Healthcaring buys Rovipharm and RR Plastiques

SGH Healthcaring's double-acquisition is supported by a Bluebay financing package

Epidarex and Sixth Element in $10m round for Adorx

Cancer drug discovery company will ramp up its research activities following the round

Syncona leads £88.4m series-B for Freeline

Gene therapy company will undertake clinical trials and look to bring its therapies to market

TVP et. al in £4.4m round for Micrima

Developer of breast cancer screening systems will bring its Maria product to market

Triton acquires Unident

Unident is the fund's first investment in the healthcare sector and was led from the Nordic office

Advent gears up for launch of third life sciences fund

VC makes investments in life sciences companies based in the UK, continental Europe and the US

Advent buys Deutsche Fachpflege from Chequers

Current management team will retain a stake in the new company and remain in their positions

Invision launches sixth buyout fund

Fund was registered in Jersey on 5 December 2017 as Invision VI Limited Partnership

Nazca Capital backs Phibo

Company will use the fresh capital to increase its production capacity and boost its market position

Vitruvian buys Doctari

GP draws equity for the transaction from its €2.4bn buyout fund, Vitruvian Partnership III

Index Ventures leads $66m series-B for Kry

Funding round also sees existing investors Accel, Creandum and Project A participate

SHS-backed Novo Klinik buys Innocath

Novo Klinik is expanding its product portfolio in the field of airway management

Apposite Capital closes Healthcare Fund II on £144.5m

Healthcare-focused Apposite seeks to deploy ТЃ10-20m over the life of an investment

Idinvest et al. inject $15m into Biomodex

Funding round is led by Idinvest Partners and InnovAllianz, with previous backers returning

LGT, Cambridge Innovation in $100m series-B for CMR Surgical

Investment round for surgical robotics company was led by Zhejiang Silk Road Fund

OrbiMed et al. back €40m series-B for Enyo Pharma

Historical and new investors back Enyo Pharma, which researches drugs inspired by viruses

ICG acquires Suanfarma

Following the transaction, Suanfarma's founder and CEO Hector Ara will stay on with the business

VC-backed ViroGates readies for Copenhagen IPO

Offer price is DKK 91 per share, which equates to a market capitalisation of DKK 276m