Healthcare

EQT exits Roeser after seven-year holding period

PE house sells the German distributor of medical supplies to private hospital firm Sana Kliniken

Ysios, Omega lead €15m series-A for Anaconda Biomed

Additional backers include Banco Sabadell and existing investor Innogest Capital

BC Partners buys DentalPro from Summit

Deal is the second transaction for the GP's 10th buyout vehicle, BC European Capital X

M Capital, Normandie Participations lead €4.7m Robocath round

Backers are joined in the round by previous investors Go Capital and NCI Gestion

Vesalius Biocapital holds €65m first close for third fund

Vesalius Biocapital III will accept new investors on a "rolling closing" basis until final close

Vendis Capital invests in Sylphar

Transaction marks the sixth investment made from Vendis Capital II, closed on €180m in May last year

LSP leads €15m series-A for Cardior Pharmaceuticals

New funding will allow the company to develop its lead compound, which targets RNAs linked to heart failure

HTGF et al. invest in Numaferm

European Investment Fund and angel investors also participated in the seed funding round

PAI enters exclusivity with Ergon for EliTech SBO

Ergon bought the medical equipment maker in 2010 in a deal valued at more than €100m

Gimv acquires stake in MVZ Holding

Gimv will provide financial and strategic support for MVZ Holding’s growth and acquisition strategy

Apposite Capital leads €7m round for NIMGenetics

Deal is the third acquisition for the GP's 2016-vintage vehicle, Apposite Healthcare Fund II

EMBL and Life Sciences Partners sell Luxendo to Bruker

Bruker will expand its portfolio with the addition of Luxendo's microscopes and intellectual property

Novartis, Columbus et al. in €37.5m series-A round for Vivet

Other investors in the round include Roche Venture Fund, HealthCap, Kurma Partners and Ysios Capital

BIVF at al. lead €20m series-A for ImCheck Therapeutics

Backers include Kurma Partners, Idinvest, Gimv and Life Sciences Partners

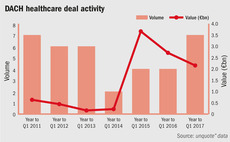

Shot in the arm for DACH healthcare market

Consolidation opportunities in the mid-market fuel increased investment from private equity, with aggregate volume reaching a six-year high

Eurazeo sells Colisée to IK Investment Partners

Sale follows a three-year tenure and reportedly values the care home operator at €236m

B&M Gates and VCs hold $45.5m series-D for Arsanis

New funding will be used to focus efforts on a phase II study for the prevention of pneumonia

Bain and Cinven publish Stada offer document

Offer values company at €5.3bn, the largest PE-backed takeover bid ever launched in Germany

HTGF and IFH back KSK Diagnostics

New funding will be used to develop point-of-care tests by utilising isothermal amplification technology

AGIC acquires laser manufacturer Fotona

Fotona will use the new funding and local support from AGIC to expand its sales effort in Asia

Advent France Biotechnology holds €64.75m first close

Firm was launched in 2016 and targets early-stage companies in the life sciences sector

BC's Elysium acquires Badby from Patron

BC Partners bought 22 mental health facilities in the UK, formerly part of Priory Group, in November

Cinven backed Synlab raises €250m via capital increase

Cinven will remain the majority shareholder of Synlab and other LP will retain its current stake

Deal in Focus: Bain and Cinven to take Stada private

Acquisition of German pharmaceutical company would be the largest buyout ever recorded in the country