Sector

Triton reaps 4x gross money in Ewellix trade sale

Valued at EUR 582m, deal for industrial tech group marks first exit by Triton V

Unigestion invests in Afinum-backed bakery chain Zeit für Brot

Majority owner Afinum will transfer its stake in the company from its 2017-vintage Fund 8 to its newest fund

Ambienta plans asset class expansion following EUR 1.55bn Fund IV close

Environmental investor set for first deals with new fund in 2023 as it assesses a foray into new asset classes and geographies, founder and managing partner Nino Tronchetti Provera tells Unquote

World Fund leads EUR 128m raise for quantum computing group IQM

Series-A2 for Finnish startup focused on combating the climate crisis also backed by the EIB

EQT to target trade players in Kfzteile24 auction

Houlihan Lokey is advising on sale of German car parts e-retailer held in the GP's Mid Market Fund

SHS nears EUR 250m hard cap on sixth fund

Healthcare fund’s EUR 200m target exceeded in first close with commitments from around 60 LPs

IK to sell Linxis Group to Hillenbrand for EUR 572m

Agreed sale of packaging machines group to US-based industrial buyer set to complete by year-end

AM Ventures holds EUR 100m final close for debut fund

Industrial additive and 3D printing VC expects to make two to three deals this year

CBPE in exclusivity to acquire Palatine-backed Veincentre

UK varicose vein treatment clinic was put up for sale in a Grant Thornton-led auction

LDC mandates Houlihan Lokey for MSQ Partners exit

Formal auction for the UK-based marketing communications group has not yet been launched

ECI sells Bionic to Omers reaping 4.8x

Following the sale of the UK-based SME price comparison platform, ECI will reinvest via ECI 10

VC Profile: Vektor Partners backs tech mobility transformation with new fund

VCтs debut fund has a EUR 175m hard-cap and aims to back startups with initial tickets of EUR 3m-EUR 5m

Tenzing sells CitNOW to Livingbridge; reaps 9.6x return, 74% IRR

The vendor will continue to back the UK-based car dealership software group via other funds

Ardian exits majority stake in Opteven to Apax

New owner will aim to accelerate the insurance provider's international growth

Cinven plays long game with financials fund in hunt for 3x returns

With a life of 15 years, the new vehicle has closed above target, with insurers making up about a quarter of its LP base

Charterhouse expected to launch Optima's sale by early 2023

Owner is yet to appoint advisors to guide it on exit of Italian food ingredients producer

Investindustrial to reap 2.5x money in Natra sale to CapVest

New owner will support Spanish chocolatier's organic growth and potential transformational acquisitions

Astorg, Epiris to split Euromoney in two in GBP 1.6bn agreed offer

The deal will see Astorg carve out the Fastmarkets commodity pricing brand, with the remaining business controlled by Epiris funds

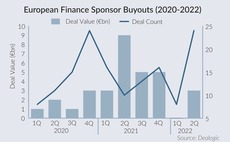

Sponsors brave the storm amid drop in financial services M&A

GP buyouts in the financial services space reached a two-year high in H1 2022 as rising financing costs and a brewing recession cloud the sector's M&A outlook

DPE-backed building service provider Calvias files for insolvency

GP had placed the technical building service provider up for sale in late 2021, according to Mergermarket

Epiris buys Sepura in EUR 159m carve-out deal

UK-based manufacturer of digital walkie-talkies was divested by Chinaтs Hytera Communications

FPE Capital invests in Dynamic Planner

Deal for the financial software provider marks second platform investment from GBP 185m Fund III

Bridgepoint picks Macquarie for sale of Cambridge Education Group

Auction of UK-based pathway programme provider slated for late this year, early 2023

COI Partners launches DACH growth fund with EUR 120m target

GP's first institutional fund will invest on a 50:50 basis alongside the sponsor's own deal-by-deal vehicles