Sector

IK Partners readies Nomios for upcoming sale process

Bank of America will advise on the auction for the Dutch IT services group, formerly known as Infradata

Pinova sells Sill Optics to DPE

Sale of German precision optics manufacturer agreed in bilateral deal

Cornerstone VC holds GBP 20m first close for debut fund

Investments will target UK tech-enabled businesses at pre-seed and seed stage led by diverse teams

McWin closes EUR 500m restaurant fund backed by ADIA

Food specialist also set to start fundraising for EUR 250m food tech vehicle next month

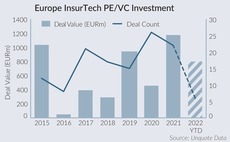

Sidekick spinoffs: Insurtech scale-ups attract PE interest

Investment set to break EUR 1.1bn mark this year as sponsors seek for rising stars

Cinven to sell Tractel to trade for EUR 500m

Exit to Sweden-listed Alimak values safety products specialist at 10.3x EBITDA

LDC reaps 4x returns in Aqualisa GBP 130m trade exit

US-headquartered Fortune Brands plans to accelerate growth of shower products manufacturer

Gilde Equity exits Avinty to Main Capital

Dutch e-health solutions supplier is software specialist's first move into healthcare

Permira to exit Vacanceselect to PAI-backed European Camping Group

French campsite operator will have approximately 10% market share in Europe after the acquisition

Aurelius to buy Footasylum following antitrust ruling

Deal values high street sneaker retailer at EUR 45m as owner JD Sports forced to divest

Montagu to exit Arkopharma for EUR 450m

Sale of French supplement maker leaves two unrealised assets in 2010-vintage Montagu IV

Aksia creates Italian Food Excellence Group with three new deals

Acquisitions include Buona Compagnia Gourmet, exited by Gradiente, and Siparex

IK Partners in exclusivity to sell Exxelia to US trade

Aerospace electronic components group to be acquired by HEICO Corporation for EUR 453m in cash

Aliter Capital readies Ipsum for post-summer auction

DC Advisory to lead on sale of UK-based utilities and infrastructure services provider

Tikehau et al. sell majority stake in GreenYellow to Ardian

French sponsors to reinvest in the renewable energy firm following EUR 1.4bn deal

TPG Growth invests in lyric library Musixmatch

The sponsor closed its latest growth fund in August 2021 at USD 3.6bn, and has seen fast deployment

CD&R to form facilities management group with two primary buyouts

Family-owned Atalian and OCS will merge to create platform with presence in Europe and Asia-Pacific

Advent invests PE-backed Seedtag with EUR 250m-plus deal

Deal for Spanish digital ads firm marks partial exit for Oakley Capital, Adara and All Iron Ventures

Synova V holds first and final close on GBP 875m hard-cap

The fund has a GBP 250m pool earmarked for smaller deals and expects to make a handful of DACH and Nordics investments

Oakley to combine Grupo Primavera with Silver Lake's Cegid

Merged software groups valued at EUR 6.8bn; Oakley becomes minority investor alongside KKR and AltaOne

BC Partners to join Bain as co-investor in Fedrigoni

Valued at around EUR 3bn, the Italian paper and label manufacturer will also receive co-investment from Canson Capital

DBAG prepares Cloudflight for sale launch late this year

GP aims for 20x EBITDA valuation for German IT services and software consultancy

Ergon readies Opseo for exit advised by Goldman Sachs

German outpatient intensive care clinics to be marketed off EUR 60m-70m EBITDA

Trilantic to buy Passione Unghie in SBO from Orienta

Incumbent GP and founders retain minority stake; deal includes unitranche led by Eurazeo and HIG