Sponsors brave the storm amid drop in financial services M&A

Private equity has remained a driving force for deals in the financial services sector so far this year even as concerns over rising financing costs and a brewing recession cloud the outlook for M&A in the coming months.

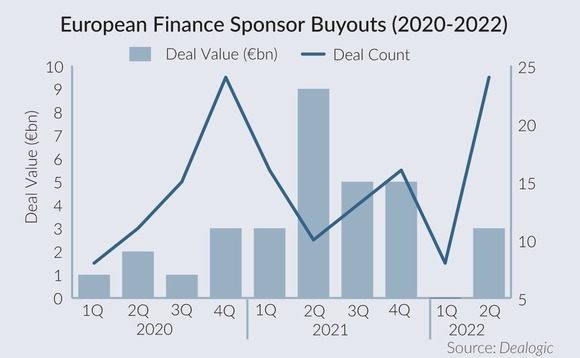

H1 2022 saw 32 sponsor-led buyouts, the highest number in two years, while the total of transactions in the financial industry dropped to 313 from 420 in the same period last year, as discussed in Mergermarket's latest European Financial Services Trendspotter.

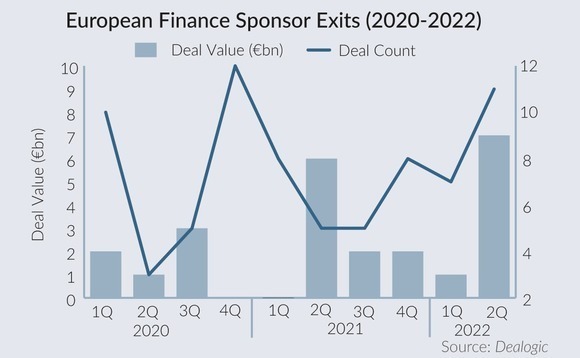

While the value of disclosed buyouts was also down, financial investors pulled off 18 exits in the last six months amounting to EUR 7.3bn based on disclosed terms, marginally beating last year's records, according to Dealogic data.

Most of them were announced after Russia's invasion of Ukraine, in spite of the IPO path being practically shut and market dislocation disrupting some auction processes, such as CVC's intended multibillion sale of Dutch corporate services provider TMF Group, as reported.

Private equity funds are still sitting on a pile of cash ready to be invested, according to Linklaters partners Andreas Steck and Tracey Lochhead, who specialise in financial institutions.

Just this week, Cinven announced the final close of its inaugural Strategic Financials Fund (SFF) at EUR 1.5bn of capital committed, a dedicated vehicle targeting insurance, specialty finance and wealth management investments.

US-based Motive Partners also announced earlier this week it has raised USD 2.54bn in the final close for Motive Capital Fund 2 and its affiliated co-investment vehicles. The capital will be invested in areas such as banking and payments, capital markets, wealth and investment management, and insurance.

However, the existing gap between buyers' and sellers' valuation expectations due to the recent market derating has yet to close, Steck and Lochhead said.

For example, fintech companies that previously traded on high revenue multiples are likely to remain under pressure, said Tassilo Arnhold, a partner at midmarket sponsor AnaCap, adding that his firm had made a conscious decision to stay away from those types of businesses.

This week, loss-making buy-now-pay-later (BNPL) giant Klarna confirmed press reports that it had raised cash at a fraction of the USD 46bn valuation it commanded a year ago, describing the adjustment as "on par with its public peers". Smaller UK rival Zilch, which as of March was still mulling a 2022 IPO, said in late June that it had managed to preserve its USD 2bn+ valuation at an extension to its Series C round.

AnaCap plans to continue investing in entrepreneurial businesses with strong fundamentals at the intersection of technology and financial services, Arnhold said. Last month, it announced the acquisition of Madrid-based Further Underwriting, an insurance managing general agent (MGA) specialising in severe illness, with a view to helping it grow both organically and via acquisitions.

However, the sponsor is cautious about the rising cost of debt, Arnhold said, adding that some deals are now being structured without leverage.

Credit availability may be particularly key for larger transactions that have traditionally relied on the high yield bond or syndicated loan markets, dealmakers said, with reports of banks struggling to offload previously underwritten debt.

This might mean that CVC has to wait to launch its expected sale of French insurance broker April Group until there is better visibility on debt financing, dealmakers suggested. Sources previously told this news service that April could be valued at up to EUR 2.5bn based on the high EBITDA multiples secured by other insurance intermediaries in France.

However, reports abound of direct lenders moving aggressively to replace banks, even in larger transactions.

If it ain't broker…

The insurance broking sector has become exceptionally popular among financial investors thanks to its attractive cash flows and consolidation potential.

Take Ardian's investment last month in TA Associates-backed Groupe Odealim at a valuation north of EUR 900m. The deal included unitranche financing led by Arcmont Asset Management, with an additional credit line being lined up for bolt-on acquisitions, as reported.

Financial investors are readying portfolio assets to be able to move when the time feels right, as reported. But what the second half of the year will ultimately look like is anyone's guess, as things could go either way depending on the economic situation, said Lorna Tennent, a fellow Linklaters partner who focuses on insurance, whilst noting that her pipeline is as busy as it was a few months back.

More sponsors want exposure to Europe's life insurance market following in the footsteps of the likes of Apollo Global Management, Tennent said, defying a perception that it is harder for funds to hold those businesses because of their long-dated liabilities. This increasingly involves discussions around alternative investment platforms, such as Bermuda-based reinsurance structures, she said. Apollo, a pioneer in the space, previously set up offshore reinsurance platform ACRA to invest in life insurance and retirement liabilities.

However, the back-book market has recently seen something of a slowdown on the back of rising interest rates, traditionally viewed as a tailwind for life insurers, said Israel Fernández del Sol, co-head of Credit Suisse's Financial Institutions Group (FIG) in EMEA. With rising rates boosting yields, some insurers are pausing for breath to reconsider pricing whilst buyers assess the long-term rate outlook, he said.

In general insurance, there is appetite for specialist businesses that have an edge in underwriting certain types of risk, Linklaters' Tennent said. Take US insurance broker Acrisure's acquisition in March of Volante Global, a Lloyd's of London MGA underwriting niche risks.

Shareholders of Bermuda-based insurer Randall & Quilter recently led a USD 125m cap hike to support a standalone strategy after marginally rejecting a 20%-premium offer by sponsor-backed Brickell, a deal agreed by the company following the discovery of a capital shortfall in its legacy insurance operation.

And though the investment management sector has seen assets under management (AUM) impacted by volatility, companies have continued to test the waters for new investment. Just last month, US sponsor Lovell Minnick Partners acquired London & Capital, a UK wealth manager overseeing GBP 4.1bn of assets with an expat clientele. Earlier in the year, Oaktree Capital Management sold independent financial advisor (IFA) consolidator Ascot Lloyd to Nordic Capital.

Mergermarket reported earlier this month that Brompton Asset Management, led by Jupiter Fund Management founder John Duffield, had been put on the market with Fenchurch Advisory. For its part, Caledonia Investment is reportedly mulling a sale of fund manager 7IM.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds