Sector

Vistra catches Warburg Pincus's eye in bilateral sale talks

Appetite for corporate and fund administration businesses has picked up in recent months

Intertrust gathers interest from other suitors following CVC offer

Several parties have submitted proposals at offer prices of up to EUR 22 per share

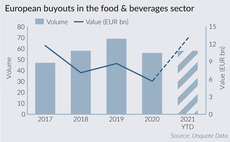

Food and beverage buyouts to reach EUR 13bn in 2021

An average of 44 buyouts totaling EUR 5.1bn were completed in the sector from 2011-2020

Advent buys Caldic from Goldman Sachs

GP plans to merge the speciality chemicals producer with São Paulo-headquartered Grupo Transmerquim

UVC holds final close for third fund

UVC Partners has a deployment capacity of EUR 255m with its flagship fund and new Opportunity Fund

La Maison Bleue piques sponsor interest as auction kicks off

Ardian is considered to be a keen bidder given its interest in the sale of nursery business Grandir

G Square transfers ISPS to new fund after sale talks with PAI collapse

Sponsor refinanced the business with incumbent lender CVC and another direct lender as part of the transfer

CVC buys Unilever's tea business for EUR 4.5bn

European food and beverage buyouts are now set to reach EUR 13bn in 2021, according to Unquote Data

Invision's Dr Deppe to hit DACH auction pipeline

Invision has mandated Rothschild for the sale of the disinfectants and cleaning-products specialist

Valedo's Norva24 to list in Stockholm

Since inception in 2015, Norva24 has grown from NOK 150m in revenues to NOK 2.1bn

ArchiMed buys Cardioline

Cardiology telemedicine platform is the first deal from the GP's EUR 650m MED III fund

Tencent leads GBP 60m round for Ultraleap

Company develops haptics hardware technology, allowing touch-free interaction with devices

Altor, Equistone, Polaris among bidders for Troldtekt

Danish manufacturer of acoustic panels is in an advanced process led by Clearwater

Spotlight on Spacs: Mobility sector ready to ride

With investors pressing for shorter merger deadlines, mobility-focused targets may fit the bill just fine

Sofinnova holds EUR 150m close for third biotech fund

Impact fund has made two investments as of its interim close and expects to make 10-12 in total

Carlyle clinches AutoForm in SBO from Astorg

Permira, Onex, EQT, KKR and Hellman & Friedman, as well as industry players, were also tipped as potential bidders

Mobeus's Equip Outdoor Technologies mandates KPMG for potential sale

Equip Outdoor Technologies is the parent company of specialist outdoor brands Rab and Lowe Alpine

Bregal, Armira go head to head for IK Multimedia

Management, advised by GCA Altium, has selected offers of more than 10x EBITDA

Assos of Switzerland for sale with William Blair advising

Sale process is advanced, with second-round bids expected near the end of this month

Graphite buys Opus Talent Solutions

Deal is the eighth investment from the GP's GBP 500m Graphite Capital Partners IX fund

Waterland sells Cawood for 3.7x money

Trade sale to EBI is the first exit from the GP's GBP 2bn, 2017-vintage fund Waterland VI

AutoForm bidder pool narrows to include Carlyle, Francisco Partners

Sale of the business has tightened after attracting early interest from a raft of sponsors and trade players

ICG to exit Park Holidays in GBP 900m trade sale – report

ICG acquired the caravan holiday park operator in a GBP 362m SBO from Caledonia Investments in 2016

GP Profile: Adelis steps up deal-making after latest fund close

Co-managing partner Jan У kesson and head of IR AdalbjУЖrn Stefansson speak to Unquote about the Nordic mid-market-focused GP's fundraise and deployment plans