Food and beverage buyouts to reach EUR 13bn in 2021

Following CVC Capital Partners' EUR 4.5bn acquisition of Unilever tea unit Ekaterra, the value of announced food and beverage buyouts is set to top a five-year record, at EUR 13bn, according to Unquote Data.

CVC acquisition of Ekaterra followed a competitive auction process that saw interest from sponsors including KKR, Advent International and Bain Capital, as reported.

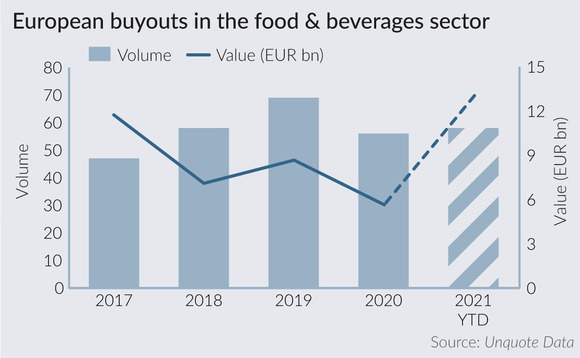

Announced food and beverage (F&B) buyouts in Europe in 2021 have reached EUR 13bn in aggregate value across 58 deals, a five-year value high for the sector, according to Unquote Data.

Activity in 2021 will therefore exceed the record EUR 11.7bn posted in 2017 across 47 deals. That year also saw a large-cap Unilever carve-out, with KKR acquiring its food spreads division in a EUR 6.8bn deal.

According to Unquote Data, an average of 44 buyouts with an aggregate value of EUR 5.1bn were announced on a yearly basis between 2011 and 2020. However, 2011 was a notable low-point in deal activity, where just 29 F&B buyouts totalling EUR 1.7bn were completed. Nevertheless, 2021 is likely to stand out as a record year for the past decade.

Unquote explored the trends driving activity and pricing in the food and beverage sector with Clearwater International as part of the Clearwater Multiples Heatmap for Q2 2021, which can be accessed here.

Trends emerging that are driving growth in F&B include consumer consciousness of healthy eating and plant-based food alternatives, as well as a tendency towards drinking and cooking at home under various coronavirus lockdowns. In addition, digitalisation has accelerated direct-to-consumer channels, Clearwater's head of F&B, John Sheridan told Unquote.

In the B2B portion of the sector, PE players have seen opportunities that can emerge from speciality ingredients producers, Clearwater managing partner Philippe Guézenec noted.

F&B-adjacent specialised consumer services have also benefited from these trends; in November 2020, beverage delivery startup Flaschenpost was acquired by Dr Oetker at a EUR 1bn valuation, as reported. Meanwhile, VC-backed grocery delivery startups, including Gorillas and Getir, have raised significant amounts of capital to scale their operations throughout Europe.

That's the spirit

As reported by Unquote sister publication Mergermarket, at-home consumption of both alcoholic and soft drinks during the coronavirus pandemic are likely to boost deal activity in the sector. CVC is to acquire London- and Prague-listed Stock Spirits following a GBP 767m bid issued in August, as reported, which will further boost deal value on completion.

F&B companies currently in the market or expected to come to market include PAI's Netherlands-headquartered beverage bottler Refresco, which could be listed in a US IPO in 2022; and Apax-backed Europe Snacks, expected to be put up for sale in 2022, with interest expected from sponsors. CapVest entered into exclusive talks to acquire Europe Snacks following an initial attempted sale process in 2019, Mergermarket reported.

Italy-based speciality food ingredients business Italgelatine has drawn bids from sponsors including Chequers Capital, Clessidra Private Equity, Peak Rock Capital and Stirling Square Capital Partners in its ongoing process, which it placed on hold due to the large number of offers received, Mergermarket reported earlier this month.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds