CEE could arrest exit flow decline in 2016

Exits in central and eastern Europe have been declining since 2011, according to unquote” data and Invest Europe figures, but strong numbers in Q1-Q3 hint at a potential rebound in exit pace this year. Mikkel Stern-Peltz reports

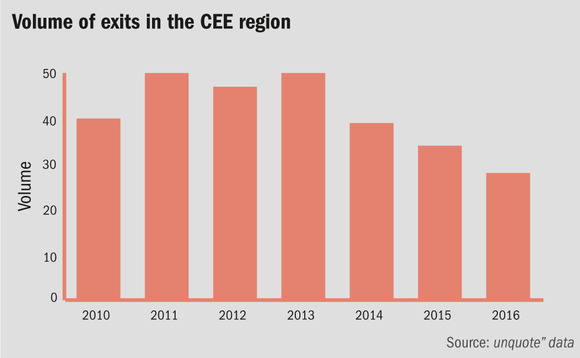

The number of private equity and venture capital exits in central and eastern Europe have been in decline since 2011, when unquote" data registered 50 exits, hitting a five-year low of 34 exits in 2015. So far in 2016, CEE private equity appears to be continuing the downward trend, having registered 28 exits at the time of publication. An additional seven exits would be required to arrest the region's post-crisis decline.

The industry leaders who gathered at the unquote" and Mergermarket CEE Series conference in Warsaw in late September appeared cautiously optimistic that the region could buck the declining exit flow in 2016.

Pawel Padusinski, partner at CEE-focused buyout house Mid Europa, said during the leaders' debate that his firm had a few exits in the pipeline, as did Valeri Petrov of Romania and CEE private equity manager Axxess Capital. The latter said the region could be seeing an accumulated demand for exits.

If entrepreneurs want a double-digit EBITDA multiple for their companies from private equity, it also means private equity sellers can expect double-digit multiples for our portfolio assets as well" – Jacek Siwicki, Enterprise Investors

Polish GP Enterprise Investors said earlier this year it was exploring exit routes for its Romanian discount supermarket chain Profit, and multiple unquote" sources in CEE say they expect to announce exits in Q4. The current market would appear to support an attractive exit environment, as GPs are seeing entry multiples drift upwards.

Enterprise Investors president Jacek Siwicki said at the conference in Warsaw: "If entrepreneurs want a double-digit EBITDA multiple for their companies from private equity, it also means private equity sellers can expect double-digit multiples for our portfolio assets as well."

However, the region is experiencing prolonged holding periods for assets, which figures into the declining exit numbers. One GP said investors might be finding companies in the right sectors and exposed to the right market factors, but the region struggles with ongoing issues of how the companies are managed, which creates a longer hold as the GP works with management.

"It's a challenge for the whole market that when it comes to sophistication of management teams and strategic thinking, things are still somewhat lacking," said Khai Tan, chair of Bridgepoint's CEE business. He also said the environment has changed since the financial crisis and comparing holding periods before and after is problematic: "You cannot compare like-for-like before and after the financial crisis. It cost everybody about two-to-three years to recover from that."

Exit strategy

Exits were also the main topic of a live interview with Kaido Veske, co-founder and partner at Baltic newcomer buyout firm Livonia Partners, where he argued exits are more important than entries for firms in CEE.

"It's a vicious cycle: if you don't exit, your track record will suffer on realised returns, which will impact your fundraising, which will impact your next fund," Veske told unquote". "Until this region proves that it can complete exits as successfully as it can acquisitions, the jury is still out on central and eastern Europe."

Data compiled by Livonia from Invest Europe numbers shows entries by CEE funds with primary offices in the region outpaced exits every year between 2007 and 2014. The figures presented by Veske show that GPs in the region have largely exited their pre-crisis assets, with around 37% remaining unrealised in portfolios.

When we speak to LPs, they are definitely concerned with the overall exit pace in the region. That has an impact on investor appetite" – Kaido Veske, Livonia Partners

Meanwhile, a whopping 68% of assets acquired in 2011-2012 – currently at the four-to-five year hold period targeted by private equity – remain unexited, as is the case for 61% of the 2009-2010 portfolio crop.

Veske says there are likely to be GPs in the region who see continued growth potential in their portfolio companies and are extending their holds to capture that added value, but it is difficult to say how much that is the case, as opposed to GPs not exiting for other reasons.

"If you look at the data, we should not be that far behind western Europe," Veske says. "But we are – and I think part of the reason is the strategic players coming from outside CEE don't need to be here. You have to work with them early on and convince them they have to be here and have good assets in hand. A year out is too late to start working on an exit."

While 2016 may yet end on a positive note for CEE, Veske says the lack of exits still looms: "When we speak to LPs, they are definitely concerned with the overall exit pace in the region. That has an impact on investor appetite."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds