Deal in Focus: Hannover Finanz backs PWK's MBO

Buyout investor Hannover Finanz recently backed the MBO of German automotive components maker Presswerk Krefeld (PWK) from US corporate MacLean Fogg Company. Amid lacklustre dealflow within the sector, Amedeo Goria takes an in-depth look at the GP’s consolidation play

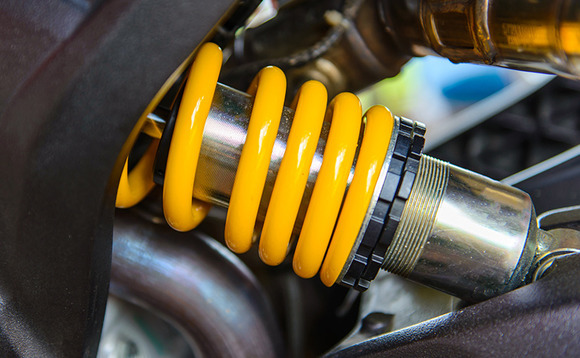

Despite a backdrop of gloomy dealflow across the German automobile components sector, Hannover Finanz backed the management buyout of linkage and suspension manufacturer PWK, a business founded in 1898 and based in north Rhineland, the beating heart of industrial Germany.

According to unquote" data, the German auto parts sector has witnessed a plunge in activity since seeing €3bn deployed across 12 transactions in 2005. The past decade, by comparison, has seen an annual average of €486m in aggregate value across five deals.

As part of the latest transaction, Hannover Finanz acquired a controlling stake in the business from the Illinois-based conglomerate MacLean-Fogg Company, while the management team retained the remaining stake, the GP said in a statement. The German firm will now look to navigate a substantial market consolidation route during its tenure.

"Due to its ability to cover the entire cycle of production and machining, PWK Automotive is now able to close large deals with its clients, which the two companies as standalones would not have been capable of" – Volker Tangemann, Hannover Finanz

According to Volker Tangemann, partner at Hannover Finanz, the deal originated when PWK's management team became interested in acquiring two German businesses, Gebrüder Kunze and Ibex Automotive, together known as Kunze-Gruppe, which were said to be insolvent at the end of April 2016. PWK's previous owner, MacLean, was not able to support the transaction, unquote" understands.

As part of the bankruptcy process, Kunze-Gruppe fell under the management of German insolvency and administration firm Hermann Wienberg Wilhelm (HWW), which was reportedly seeking investors willing to step in. According to a statement, the law firm was confident of signing a sale agreement by the beginning of the following summer in 2016, but the process lasted longer than forecasted.

Although it filed for insolvency due to the rise of its debt burden, "the group was an attractive asset" for PWK, says Hannover Finanz's Tangemann. During the last decade, the management team deployed a large amount of capital to boost production through the acquisition of new machinery, he explains. Furthermore, the group maintained most of its blue-chip clients and continued with its metal-cutting machining production.

Forging a future

Due to the complementary nature of Kunze-Gruppe to PWK, the latter decided pursue a deal in order to expand its production line, which had centred on precision forged steel and aluminium components. According to Tangemann, the consolidated group will offer a whole production cycle for automobile components and provide added value for its combined client base.

"Due to its ability to cover the entire cycle of production and machining, PWK Automotive is now able to close large deals with its clients, which the two companies as standalones would not have been capable of," says Tangemann. Additionally, he argues "large conglomerates increasingly outsource parts of their business, while aiming concurrently to include functions from their original-equipment manufacturers (OEM). Therefore, PWK will now be able to take a large share of this niche market, due to its ability to cover the entire cycle of production and machining of its components."

Following the transaction, PWK took control of production plants in Gelenau and Zittau, and an administrative office in Schönbrunn, Saxony, as well as inheriting 400 employees. The Kunze-Gruppe – with turnover of €40m in 2016 – will be rebranded as PWK Ibex and will sit alongside PWK, which generated €80m in revenues in 2016, in the PWK Automotive Group. In total, the group is expected to generate a turnover of €160m and employ 900 people.

Tangemann tells unquote" Commerzbank provided a credit facility to support PWK's acquisition of Kunze-Gruppe, while the GP funded the acquisition of new and existing shares on an all-equity basis.

At the time of publication, PWK Automotive was negotiating three large deals with German corporates, including Continental and ZF, unquote" understands. These agreements have a €8-9m value and PWK expects to secure them in H1 2017 without additional capital injections from its shareholders.

Advisers

Equity – Deloitte (legal); RSM Altavis (financial due diligence, tax); Ricardo Strategic Consulting (commercial due diligence).

Company – Commerzbank (M&A).

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds