French mid-cap seeks new approaches as competition heats up

Mid-cap buyout houses in France are casting their deal-sourcing net wider, as H1 data shows record levels of competition and swelling valuations. Francesca Veronesi reports

The French mid-cap buyout space was in rude health in H1, with aggregate value amounting to €7.24bn and volume reaching 68, according to Unquote Data, exceeding 2016's previous H1 record of €6.96bn across 61 deals.

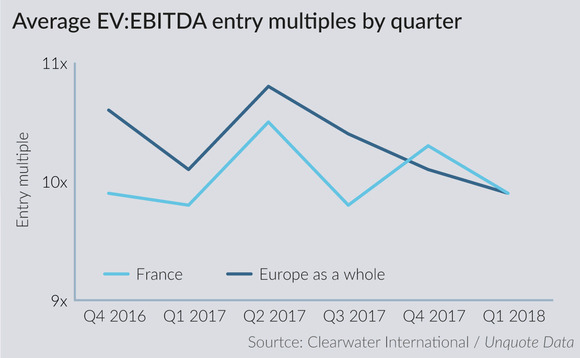

Like other European regions, the availability of high-quality assets in France is limited and prices remain high. Indeed, Clearwater International's Multiples Heatmap Q1 2018 Update, found that French private equity buyouts averaged an entry multiple of 9.9x EBITDA in the first quarter of the year, exactly in line with the overall European average.

Similarly, The Argos Index, published by Argos Wityu and Epsilon Research, analyses entry multiples for mid-market deals – focusing on privately held eurozone businesses and taking into account transactions involving majority stakes acquired by trade buyers and PE firms. The report finds multiples for Q2 2018 have hit a new record of 9.9x across the eurozone, surpassing the previous peaks of 9.5x in Q3 2017 and Q1 2018. The index finds that, while the upper-mid-market has maintained stubbornly high multiples of more than 10x EBITDA since 2017, the lower-mid-market is also now seeing growing valuations.

GPs are increasingly approaching corporates directly, looking to avoid an auction setting" – Karel Kroupa, Argos Wityu

Auctions in the French mid-market have changed in the past couple of years, says Argos Wityu partner Karel Kroupa, with pre-emptive offers becoming more frequent. "Due to the level of preparation required for auctions, bidders abandon them in some cases, focusing their energies on those they think are more likely to succeed," he says. "Otherwise, GPs are increasingly approaching corporates directly, looking to avoid an auction setting." When asked how the French debt landscape has changed, Kroupa says the arrival of direct lenders en masse has had a strong impact: "Availability of financing has never been as flexible in terms of covenants, nor as fast."

Mid-market buy-back deals, in which a business is bought by the same PE firm for a second time, show that buyout houses are considering new approaches to operating in a competitive environment. The practice is more frequent in the French large-cap space than in the mid-market, according to Unquote Data. Nonetheless, H1 has seen two mid-market deals of the sort. Equistone bought French online travel agency Groupe Karavel in March, having originally owned the business from 2007-2011. Equistone's Guillaume Jacqueau said at the time of the deal that this was the first time the GP had acquired a majority stake in a company that it had previously backed. The quality of the asset, the fact that Equistone had already worked closely with the management team and that the management approached the GP to receive backing, prompted the firm to reinvest.

Second time's a charm

Elsewhere, MBO Partenaires bought back construction equipment rental and transportation company Groupe LT, having originally held a stake in the business from 2008-2015. MBO partner Xavier de Prévoisin warns that the practice is not without obstacles: "A new GP can easily pitch to the company's owners that its approach is different from previous backers, stressing that it can think outside the box. The previous backer really needs to present the case as to how it will approach the investment differently in order to grow the business on a new scale."

Equally, by the time the second buy-back takes places, the parties involved are often very different, says de Prévoisin. The company should have increased in size and the GP might want to acquire a majority stake instead of a minority one, or vice versa. Moreover, the private equity firm's team might have changed over the years, with new partners overseeing the investment and therefore offering a fresh outlook on growth options.

Nonetheless, he says that GPs believe they have a better chance at winning an auction when trying to acquire a previously backed company. The bidding process will be quicker and, in general, less risky, says de Prévoisin, thanks to an established relationship with the management: "Rather than showing that the market is mature, buy-back deals in the mid-cap space indicate that the market is very competitive."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds