French buyouts paint new picture of recovery

The French buyout market has been slower to stir compared to the UK, Germany and even the Nordics this year. Nevertheless, a surge in activity witnessed during the summer, as well as the return of sizeable upper mid-market deals, leave industry players optimistic for the coming months. Greg Gille reports

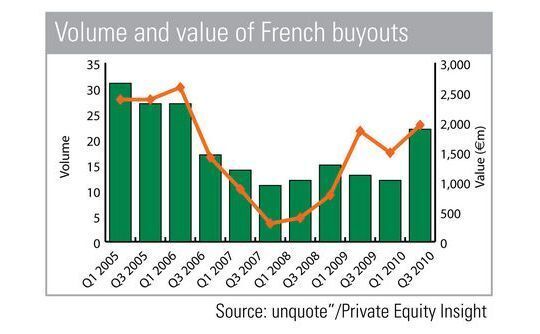

Statistics for the first half of 2010 may seem slightly unimpressive at first glance. The volume of French buyouts recorded by unquote" for that period is relatively similar to that seen in 2009 - and still a far cry from 2008. In addition, while its neighbours were taking advantage of their recovering economies to build up momentum as spring went on, buyout activity in France declined in the second quarter from 13 to 12 deals.

However, it would seem that the market has gone into overdrive as activity rapidly picked up in the third quarter, when deals finalised before the summer were announced: the Carlyle Group acquired Giannoni for €490m, PAI Partner bought Laboratoires Cerba in a €500m secondary buyout from IK Investment Partners, and Lion Capital faced tough competition to grab frozen food retailer Picard for a hefty €1.5bn. Added to the two other upper mid-cap deals done earlier in the year, these operations sent overall value invested in 2010 rocketing upwards. In comparison, unquote" recorded barely a couple of transactions exceeding €200m for the whole of 2009.

Industry players are so far relieved by the increase in dealflow, and are confident for the rest of 2010. "The situation is clearly better than last year. We now have more visibility on business plans and the general macroeconomic environment. Leverage is definitely back as well, even if it remains selective," says Lise Fauconnier, managing director for the LBO Mid-cap team at AXA Private Equity.

Patrick Sandray, head of leveraged finance in France for Société Générale Corporate and Investment Banking, concurs but puts the timing of the sudden increase into perspective: "There is a contextual factor at work here. Investors and lenders were looking to avoid the summer's market instability, and therefore wanted to finalise as many transactions as possible before the end of July."

This willingness to snatch up good assets as quickly as possible could be another effect of the downturn. Most of the industry is now on the lookout for businesses that weathered the downturn and can flourish in a recovering environment - the scarcity of those companies may go some way towards explaining why deal values are soaring. "The pricing gap has increased between good but slightly low-profile deals, not attracting much attention, and operations where investors are really competing," states Gilles Lorang, partner at Argos Soditic.

Meanwhile, on the debt front, banks are open for business again. But it appears that multiples in the 3.5-4.5x region are now the norm: "For outstanding assets like Picard, it can exceed 5x EBITDA, but not by much. It is good to see that leverage is staying reasonable, and not going back up to pre-crisis levels," notes Sandray. Banks also seem to pay far more attention to the businesses themselves - as with the GPs, a strong and resilient business model is a must.

The main question mark going forward will be whether the upper mid-market uptick witnessed in the third quarter of 2010 was purely a matter of timing. With most of the industry now on the quest for downturn survivors, here's hoping that the French economy recovers quickly enough to broaden the scope of attractive investments and keep the volume of transactions on an upward trend.

A more detailed look at the French buyout market will be published in the upcoming edition of unquote" Private Equity Europe.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds