French PE industry "could collapse", AFIC warns

The French government unveiled its proposed 2013 budget last week, deemed by many to be the country’s harshest in more than 30 years. Trade body AFIC laments a raft of “punitive” measures that could deal a killing blow to the French private equity industry. Greg Gille reports

France's business community knew that the writing was on the wall. The combination of unsustainable public finances and the election of the first Socialist majority in 10 years was likely to result in a bitter medicine come budget time – a fact reflected in the incredibly cautious attitude displayed by most investment professionals since the start of 2012.

Now that the full extent of the new Loi de Finances has come to light, AFIC president Louis Godron does not mince his words: "One can't lament the fact that France increasingly lags behind when it comes to creating innovative companies [...] and at the same time discourage retail investors from committing to the funds that back those businesses, prevent foreign investors from investing in France with absurd measures at odds with what is done in all developed countries, and take punitive action against professionals looking to back those growing businesses," he said in an AFIC statement.

The association is particularly vocal about the alignment of capital gains and income taxation. Under the proposed budget, capital gains would now be taxed at up to 45%, with an additional 15.5% in social contributions. AFIC warns of a "punitive" impact on investors and entrepreneurs, echoing the views Argos Soditic's Gilles Mougenot shared with unquote" last month.

Unsurprisingly, AFIC is also up in arms about the impact of the reform on carried interest taxation. "There is no basis for comparison between an income received at the end of every month and the long-term risk taken by investment professionals," the association stated, before adding that this would severely handicap French private equity firms in attracting top international talent.

Another sore point is the status of tax rebates for investments in retail venture funds (FCPI and FIP) vehicles. Noting that President François Hollande had previously told entrepreneurs that the existing scheme would be maintained, AFIC strongly criticised the changes introduced in the new budget: the tax rebate would now be capped at €10,000 per investor, against the current €18,000.

The association finally warned that all these measures would discourage international investors, painting the "devastating image of a country that doesn't like success and hammers them with a confiscatory tax system."

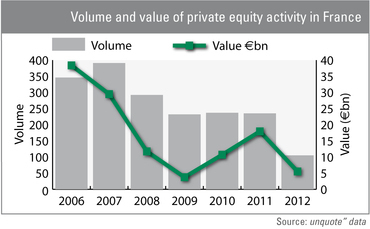

As for the French private equity industry itself, it probably could have done without the fiscal overhaul. Activity has been particularly lacklustre so far this year: nine months in, the 105 transactions worth an overall €5.5bn recorded by unquote" don't bode well compared to 2011's year-end figures (see chart below). AFIC's Godron warns that this could just be the start: "The industry, already impacted by the downturn, will collapse in France should these measures take effect."

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds