French PE market in rude health

A report published by trade body France Invest and Grant Thornton has painted a positive picture of French private equity in H1 2018, despite a slight decrease compared to H1 2017.

The document released this week by the French trade body said €6.1bn was invested in more than 1,100 startups, SMEs and mid-market companies by French PE and VC firms, just less than the record of €6.4bn seen in H1 2017.

The document added that 19% of companies backed were based outside France, which is 2.6x more than the first half of 2017, showing that France-based investors are successfully competing with their international peers for deals across Europe. Investments across the globe amounted to 4% for the first semester.

France Invest's report also highlights a sharp increase in VC dealflow, with investment increasing 42% compared with the first half of 2017, reaching €809m. An increasing number of startups are benefitting from equity tickets in the €5-30m range. Unquote reported that average venture ticket sizes were increasing, earlier in the year. Idinvest partner Charles Daulon du Laurens pointed out at the time that "the series-A of today is the size of what the series-B was a few years ago. Bigger tickets are given to start with, but equally rewarding returns are seen in exits."

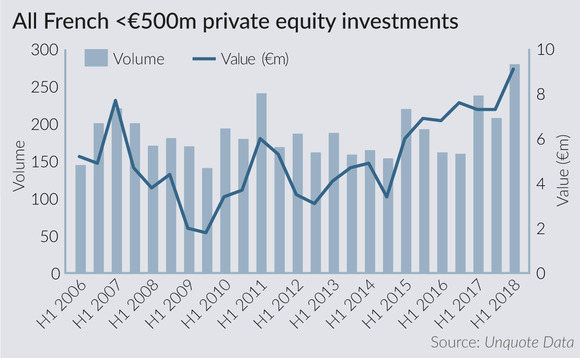

The value of investments in French companies (from both French and international investors) from seed to up to €500m hit €10.28bn in the first half of the year, according to Unquote Data.

This significantly surpasses the €8.08bn result seen in H1 2017, and deal volume equally increased from 258 to 280.

Looking at VC deals specifically, value hit €354m for a total of 52 investments in H1 2018, while the first half of the year in 2017 saw a value of €209m, for a total of 40 investments, according to the Unquote Data.

LPs, more international and diversified

The France Invest report took into account the amount raised at each closing held in 2018, including first, interim and final closes. According to the document, €6.6bn was raised in H1 2018, which is below the record of €8.1bn seen in the first half of 2017. The trade body noted that the amount raised was partially reduced by the elimination of the SME solidarity tax on wealth, which alone raised €383m during the first half of 2017.

The report found that 50% of the capital raised in the first half of the year was committed by foreign LPs, with 29% hailing from outside of Europe and 21% from other European countries. In comparison, over the 2007-2017 period, international LPs were responsible for 38% of the region's fundraising, with European investors covering 24% of investments and internationals 14%.

For example, when looking at the backing of US investments specifically, their share was relatively stable around 5% of the total fundraising between 2013 and 2016, according to a spokesperson for France Invest. However, it increased significantly since 2017, to 8% in 2017 and 13% in H1 2018.

Unquote reported in May that French GPs on the fundraising trail have wooed Chinese LPs: Sofinnova, for example, confirmed Crossover Fund 1 had received commitments from a Chinese backer in April. Idinvest partner Charles Daulon du Laurens told Unquote in May that "compared with even two or three years ago, we are seeing more European, as well as extra-European LPs being attracted by the developing potential of the French VC market".

In terms of diversification of the LP base by type of investor, the findings show a very sharp increase from pension funds, with a 53% lift compared with the first half of 2017. The semester was also marked by a larger commitment from foreign pension funds and sovereign funds, with a 75% increase from the latter, particularly from Asia.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds