Record number of French SBOs and mega-deals in H1 2018

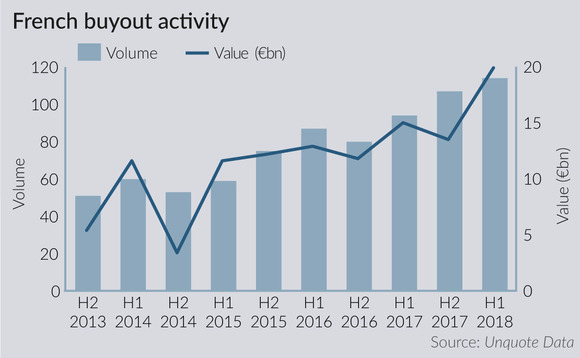

France's year is going from good to great as new figures from Unquote Data show buyout volumes reaching their highest level for a decade.

The French football team may have had a fantastic summer on the football pitches of Russia, but the country's private equity industry has also reached lofty heights: according to figures compiled by Unquote Data, there were 114 buyouts in H1 2018, the most in any half since H1 2007. Their aggregate enterprise value of €19.9bn was the largest seen since H2 2006.

By comparison, the first half of 2017 saw 94 buyouts transacted at an aggregate enterprise value of €15bn – meaning H1 2018 activity was up by a fifth volume-wise and by 26% in aggregate value.

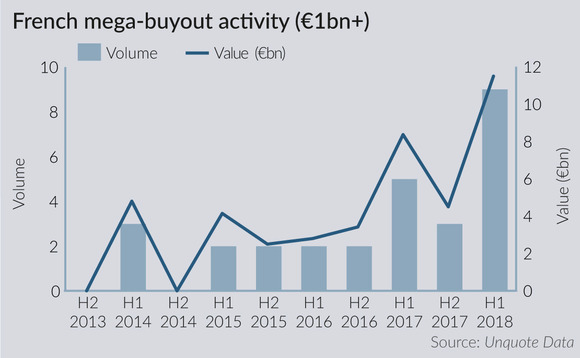

Strength was evident across all segments of the market. The mid-market (here defined as deals with EV of €100m-1bn) posted 27 transactions – a joint record-high – while a record nine mega-deals (€1bn+) were completed.

Standout buyouts that helped push the overall value recorded in H1 included industrial engineering firm Fives, with Canadian investors PSP Investments and Caisse de depot et placement du Quebec (CDPQ) acquiring stakes from Ardian at a reported EV of around €1.5bn. CDPQ was involved in another mega-buyout, with CVC selling its stake in Delachaux to the investor in a €1.3bn EV deal. Permira also bought a majority stake in cybersecurity and cloud distributor Exclusive Group from Cobepa and Andera Partners in a deal that valued the business at around €1.3bn.

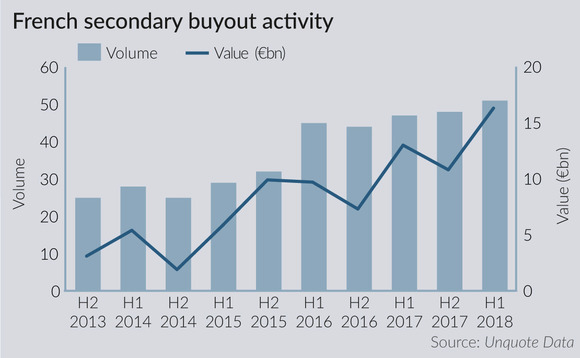

Secondary buyouts picked up, reaching a new half-yearly record of 51 deals – tellingly, 90% of the mega-buyouts recorded in H1 were transacted between private equity investors. But there has also been a decent upward trend in deals sourced from family and private vendors over the last few years. There were 54 such transactions in H1 2018, the most since H2 2007. By comparison, just 16 and 17 buyouts were sourced from family and private vendors in H1 and H2 2013, respectively.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds