French buyouts up 50% YoY in Q1

The French buyout market enjoyed a much welcome uptick at the start of 2013, with both volume and overall value significantly up on Q1 2012 figures.

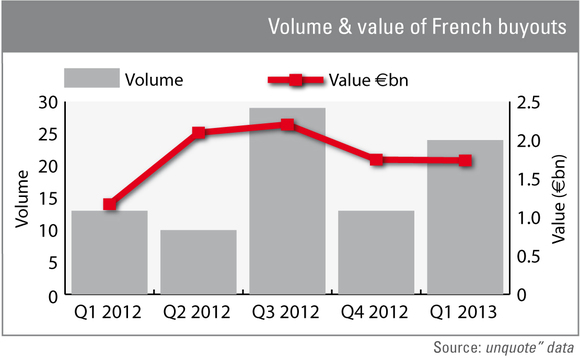

France might have witnessed a rebound in buyout activity in Q3 last year following the two rather tame previous quarters, but the figures recorded by unquote" data in the fourth quarter (€1.7bn across 13 transactions) confirmed that 2012 should be a year best forgotten in terms of dealflow.

Luckily, it would seem that French deal-doers hit the market with renewed vigour in 2013. The volume of private equity-backed buyouts nearly doubled between Q4 2012 and Q1 this year, settling at 24 transactions. While at first glance the stagnating €1.74bn value total might imply much smaller transactions being completed on average, the Q4 total was slightly skewed by the €465m buyout of IPH Group by PAI partners.

First quarter figures are also encouraging compared to the same period last year – although it must be said that the upcoming presidential elections were expected to have an adverse effect on dealflow at the time. Q1 2013 French buyout activity was nearly double that of Q1 2012 in volume terms (24 versus 13 transactions) and posted a year-on-year increase of nearly 50% value-wise (€1.74bn versus €1.17bn).

French private equity players should also welcome the fact that the country's buyout activity was virtually on par with that of the UK in the first quarter, at least in volume terms with 24 transactions each. The UK edged it in value terms though, with these 24 transactions valued at an overall €2.3bn. This largely rested on a steadier dealflow at the upper end of the mid-market, with transactions such as the acquisition of British hotel chains operator Principal Hayley by Starwood Capital for around £360m.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds