France: acquisition finance off to good start in 2012

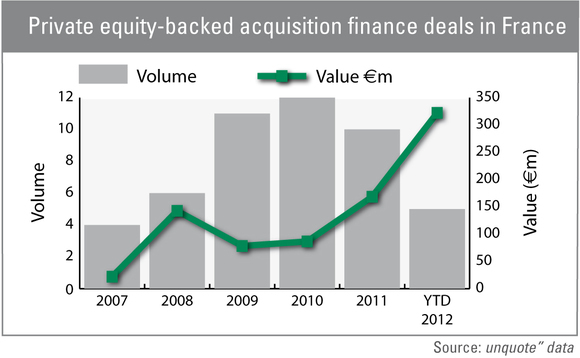

The overall value of French PE-backed acquisition finance deals completed in the first months of this year has already exceeded 2011 year-end figures. Recent research also highlights that French businesses remain hungry for build-up opportunities.

unquote" has so far recorded five bolt-ons for existing portfolio companies requiring additional funding from their private equity backers - nearly half the figure recorded for the whole of 2011. Meanwhile the overall value of these add-ons, now thought to have exceeded €300m, is already well ahead of last year's estimated €170m.

GPs can remain hopeful that this trend will continue in the coming months: despite an increasingly gloomy economic environment, slightly more than half (54%) of French entrepreneurs recently polled by state bank Oséo are currently thinking of growing their business through acquisitions - with a quarter aiming to do so in 2012. And, in what will undoubtedly be good news for an otherwise quiet private equity market, two thirds of respondents state that they would need to bring an external investor on board to finance bolt-ons.

Furthermore, the proportion of businesses needing to turn to private equity for acquisition finance increases to 88% when the amount of funding required exceeds €2m - highlighting the fact that capital sources remain scarce for SMEs in France.

It would also seem that regional investors are particularly popular: 37% of the entrepreneurs surveyed would rather turn to them for financing, while national players only attract 29% of the respondents. France's myriad regional funds, often set up by local branches of the country's major banking groups, should again welcome the potential dealflow.

But although a majority of entrepreneurs recognise the need for private equity backing, the survey shows that a significant proportion sees it as off-putting enough to warrant writing off acquisition plans. The 46% of respondents that do not intend to complete bolt-ons for the time being are mainly concerned with factors such as a dilution of their stake and the backer's expectations when it comes to valuation and exit strategy.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds