Nordics see strongest first quarter since Lehman

Despite reputational, regulatory, and macroeconomic concerns lingering from the second half of 2011, the Nordics has experienced its strongest first quarter since Lehman Brothers collapsed and brought the global economy to its knees.

The aggregate deal value for the period January to March nearly doubled from €1.5bn in 2011 to €2.7bn in 2012. This is the highest aggregate deal value recorded in a Nordic first quarter since 2007 (€6.3bn), and supports the notion of a recovering industry in the region. The main contributor to deal value is undoubtedly CVC Capital Partners' February mega-buyout of Ahlsell, with a €1.8bn price tag.

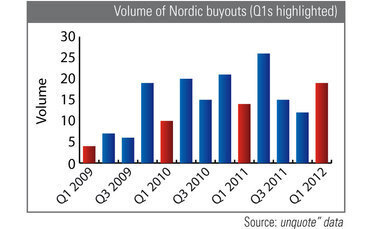

Moreover, looking at the 19 deals recorded in the region, Q1 transaction volume has outperformed every Nordic first quarter since Lehman collapsed in late 2008. Last year saw only 14 deals in the same period.

Curiously, Denmark was the strongest contributor in terms of transaction volume - being the home of seven buyouts, and slightly ahead of Sweden and Norway. This is quite remarkable, seeing that only three buyouts took place on Danish soil in the first quarters of 2009-2011 combined.

Taking a closer look at the Danish phenomenon, the majority of buyouts were completed by local investors Maj Invest Equity, Odin Equity Partners, and Axcel. The remainder, however, were Swedish buyout houses Nordic Capital, Triton Partners, and Altor Equity Partners, picking up Danish heavy industrials Bladt Industries, Nordic Tankers, and Haarslev Industries.

Conversely, Swedish buyout volume was dominated by Danish Polaris Private Equity, leading three of the buyouts: Skånska Byggvaror, Alignment Systems, and Jetpak.

Cross-border activity within the Nordics is indeed a common occurrence, and despite increased interest from international LPs the region has remained almost exclusively local in terms of GPs. Needless to say, the same rule appears to apply for debt providers.

Unfortunately, given the circumstances, the first quarter does not seem to be a good, or even reliable, predictor for following quarters. Looking back at aggregate value and volume figures from 2005 and onwards, the Nordics tends to be bumpy - and occasionally cyclical - across quarters.

The data does, however, imply that the region is faring well, despite tax headaches, aggressive media coverage, and European debt worries in late 2011. And provided that wider Europe stays relatively stable throughout 2012, the road to recovery may lead a little further than last year.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds