Tech drives Danish PE as healthcare loses ground

Vidur Sachdeva examines the changing landscape of the Danish private equity industry as tech deals take centre stage.

The latest estimates from unquote" data reveal Denmark's private equity industry has recovered remarkably well from the global financial crisis. The regional industry had fallen off a cliff in 2008 when annual deal volume dried-up by 44% (from 62 to 35 transactions). However, the four years to the end of 2015 witnessed the industry grow year-over-year before noting its highest ever dealflow in 2015 (66 deals worth €7bn). It is now evident that this recovery has brought with it a new and transformed landscape.

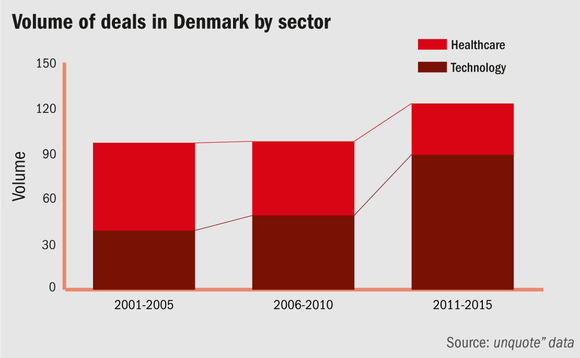

As can be seen in the chart above, Denmark was home to just 39 tech deals during the five years to the end of 2005. This improved by 26% during the next five years as the country reported 49 such transactions. The technology segment then surged to 89 deals (+82%) during 2011-2015, representing the highest number of private equity deals for any sector in Denmark.

Deteriorating health

Interestingly, the tech segment's rise has coincided with the slow and steady decline of opportunities in the Danish healthcare sector. During 2001-2005, this sector was home to 58 deals, making healthcare the busiest segment in Denmark. By 2006-2010, dealflow in healthcare had slipped to 49 deals and by 2011-2015 this estimate had dropped to just 34 transactions.

Indeed, healthcare companies accounted for 35% of all private equity deals in Denmark during 2001-2005, 24% in 2006-2010, and only 13% in 2011-2015. Meanwhile, tech deals accounted for 24% of all private equity investments in Denmark during 2001-2005, 24% in 2006-2010, and 33% in 2011-2015.

A more detailed analysis reveals the internet and software sub-sectors have fuelled the rise of Denmark's tech segment, while a decline in the pharmaceutical subsector has been responsible for the slowdown in the healthcare segment. The internet and software sub-sectors more than doubled from a combined 31 transactions in 2001-2005 to 81 deals in 2011-2015, while the pharmaceutical subsector declined from 41 deals in 2001-2005 to just six in 2011-2015.

The following are five of the largest tech deals (with a disclosed value) that took place in Denmark in the last three years:

1. Netcompany – DKK 2.3bn (est); December 2015

FSN Capital acquired Danish IT services business Netcompany in a deal with an enterprise value of DKK2.3bn – just less than 11x its EBITDA. The Oslo-headquartered GP acquired more than half of Netcompany's share capital from its three founders, Claus Jørgensen, André Rogaczewski and Carsten Gomar. A financing package comprising term loans and revolving capital facilities of some DKK 1.26bn was arranged and underwritten by Danske Bank before being syndicated to a small group of Nordic and international banks and funds.

2. EET Nordic – DKK 1.2bn; February 2015

FSN Capital acquired Danish IT products and parts distributor EET Europarts in a secondary buyout from Alipes for a reported DKK 1.2bn. The Norwegian GP won the bid for EET ahead of EQT and Segulah, while Nordic Capital, Altor and Axcel were also said to have shown an interest.

3. Bluegarden – DKK 500m (est); September 2015

Los Angeles-headquartered GP Marlin Equity Partners acquired Danish payroll and HR administration software provider Bluegarden. Marlin bought the company from a group of Danish banks, including Danske Bank, Nordea and the Danish central bank (Nationalbanken). Local newspaper Berlingske Business cited sources close to the process who put the price of the deal at DKK 500m, which would imply an entry multiple of around 8x EBITDA.

4. Trustpilot – $73.5m; May 2015

Vitruvian Partners led a $73.5m series-D for Danish business reviews website Trustpilot, in one of the largest-ever VC funding rounds for a Danish start-up. Existing investors DFJ Esprit, Index Ventures, Northzone and Seed Capital were among the main contributors to the round, which brought the total capital raised by the business to $118m. According to unquote" data, fewer than half a dozen Danish companies have raised a similar or higher amount of VC funding in the past decade.

5. Tradeshift – $75m; February 2014

Along with other investors, Scentan Ventures, PayPal, Intuit and Anzen Private Equity provided a $75m expansion stage funding to online invoicing platform Tradeshift in order to help fund its expansion plans.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds