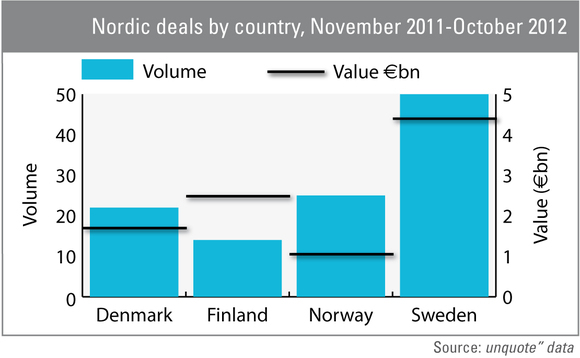

Sweden continues to lead Nordics

Sweden outpaced its Scandinavian neighbours in the 12 months leading up to November. A SVCA study shows that industry optimism returned just in time for year-end.

According to the Private Equity Managers Index, published by the Swedish Venture Capital Association (SVCA), there is new confidence in the industry.

Macroeconomic considerations continue to scare investors and feed scepticism. The poor performance across multiple sectors and indicators makes for conservative projections and the adoption of strict risk management. Additionally, Sweden's private fund industry has long been the subject of political debate: taxes on carried interest are due to be increased as in other markets like the US or Germany.

Yet, almost half of the surveyed buyout houses intend to start fundraising until 2014. Venture capitalists follow this positive lead with almost one third of surveyed firms considering raising capital.

From a financing point of view, the situation is unlikely to change: banks are hard to convince unless the fund managers' track record and the target's specs are bullet-proof.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds