Deal in Focus: Wise backs Tapì's SBO

Italian buyout house Wise is keeping a close eye on cross-border tensions between the US and Mexico, where its newly acquired Milan-based portfolio company Tapì has two production plants. Amedeo Goria reports

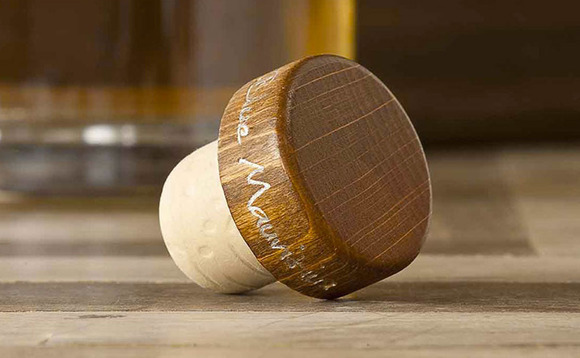

In February 2017, Wise backed the management buyout of Tapì, the Italian producer of T-shaped bottle corks that operates in the upper-end of this niche market. As part of the deal, the GP acquired a controlling stake from the company's founders Alberto Badan and Nicola Mason, and from venture capital backer Gradiente. Other private equity players were interested in the asset but Wise sealed the deal off-the-market, unquote" understands.

Roberto Casini, former CEO of the company's subsidiaries in Mexico and the US, acquired a minority stake in the business and became CEO of Tapì, while Wise partner Stefano Ghetti joined the board as vice-president. A syndicate led by Crédite Agricole FriulAdria provided an undisclosed credit facility to support the transaction alongside Italian banks Interbanca and BPER Banca, which was set below the 50% equity-debt ratio, says Ghetti.

The deal marks the third acquisition for the GP's 2015-vintage Wisequity IV vehicle, which held a final close on its €215m hard-cap in March 2016 after six months on the road. Following the initial capital injection, the GP will provide additional capital to pursue strategic acquisitions across South America – in particular in Brazil and Argentina – as well as the UK, France and Spain, unquote" understands. In 2016, the business posted €40m in revenues, which the investors aim to double within five years, according to a statement.

If cross-border tariffs are introduced between the US and Mexico, Tapì intends to open a new production plant north of the border

The company initially came under private equity ownership in December 2012 as Gradiente acquired a minority stake via its Gradiente I fund. At the time of the transaction, Tapì posted a 30% year-on-year increase in revenues to €12m and employed a staff of 87. During its holding period, Gradiente backed the company's expansion through the acquisition of Roberto Casini's business, Microcell, in 2013 and Mexican business Tapones Escobar in 2014. Two years after the Tapones acquisition, the business has a headcount of 300 and owns five production facilities in Italy, Mexico, Argentina and Russia, with sales across 60 countries.

According to Ghetti, the niche premium and super-premium spirits segment, in which the company operates, is currently driven by a polarising trend, which sees growth at both the highest and the lowest end of the sector, while the mid-cap space has stagnated. Moreover, Ghetti sees an additional driver at the highest end of the segment: premium spirits producers that are redesigning their products and tend to substitute screw-caps with T-shaped caps.

Beyond walls

These are not the only trends that are currently driving the markets. The business has two production plants in Mexico and Argentina, which largely export across Central America and the US. In the midst of the recent US election and the political disputes between the US and its neighbouring countries, the North American market represent a major focus for the company's expansion strategy.

The GP is continuously monitoring political developments between Mexican and US authorities. The current backdrop remains positive for the business, says Ghetti, with a drop in the Mexican peso causing a decrease in production costs for Tapì. However, if cross-border tariffs are introduced, the GP intends to open a new production plant in the US and is currently evaluating the areas where incentives are most attractive.

Advisers

Equity – Vitale & Co (corporate finance); Simmons & Simmons (debt).

Company – Simmons & Simmons (legal); Studio Spada & Partners (tax); KPMG (commercial due diligence); Fineurop Soditic (debt).

Vendors – Grava & Associati (legal); Studio Tributario Berto (tax).

Debt – Clifford Chance (legal).

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds