Deal in Focus: Ambienta bets on tighter market regulation with Safim

Looking to navigate negative trends across its end markets and stricter regulation, Italian machine parts manufacturer Safim has teamed up with Ambienta to support its ongoing growth phase. Amedeo Goria reports

Ambienta acquired a controlling stake in Italian industrial firm Safim from the founding Mamei family in July 2017. The GP bought the business via its second vehicle, Ambienta Fund II, which is currently deployed at more than 50%. The deal is the 25th investment for the Italian GP, which now counts 23 primary buyouts among its track-record.

Ambienta relied on an undisclosed credit facility to leverage the acquisition with a debt-to-equity ratio of less than 50%, according to a source close to the situation.

Despite recent growth, the target company has had to contend with tough conditions in its end markets during the last four years, and recently faced some succession issues, according to the same source. Therefore, the entrepreneurs – with the support of Studio Bagni – sought a financial investor that could add managerial expertise to the business, and Ambienta was chosen among several contenders, unquote" understands.

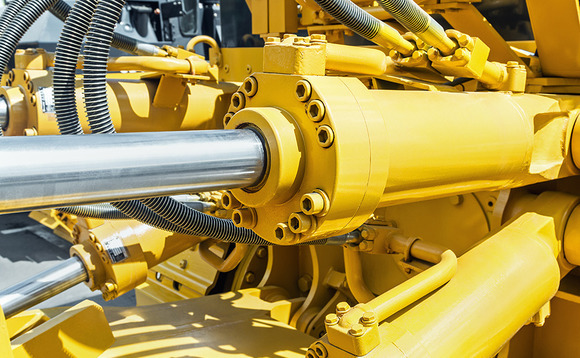

Founded in 1976, the Modena-based business manufactures valves and brake pumps with the aim to maximise safety and energy efficiency for vehicles operating in the agricultural, construction and material-handling sectors.

These sectors have been experiencing a market downturn recently. According to the 2017 annual report of the European Agricultural Machinery Association (CEMA), between 2005-2013 the client base of the European agricultural machinery industry declined at a 3.7% yearly rate, with the total number of farm holdings decreasing by 1.2 million and the average farm-holding area rising from 14.1 to 16.1 hectares. This highlights the consolidation trend at play in the sector, with tractors becoming more powerful to face the increased size of land holding and logistics costs increasing alongside competition.

Concurrently, the market is witnessing an increased focus on efficiency and cost reduction enforced through stricter regulation from the European Union. "There is a growing trend towards sustainability across the agricultural machinery industry," says Nino Tronchetti Provera, founder and managing partner at Ambienta.

The EU initially launched its emissions regulation in 1996 – Stage I was a first step in regulating emission standards for engines used in off-road mobile machinery. Gradually, it structured more stringent tiers named Stage II, Stage III and Stage IV, specifying emission requirements for all off-road engines, including tractors, railroad locomotives and marine engines. Additionally, Stage IV will be in force until 2018, with Stage V taking over in 2019.

In particular, Stage V will introduce particulate number limits and emissions limits for engines used in the agricultural sector. With this step, EU environmental requirements for agricultural machines will become the strictest in the world.

"Everything that occurred to the on-road segment, which includes cars and heavy vehicles, is now reaching the off-road sector. The regulation on emission cuts and energy efficiency is increasingly affecting the European market and Safim expects to take advantage of this new environment," says Tronchetti Provera.

More with less

According to research company Cummins Emission Solutions, since the enforcement of Stage I up until the launch of Stage IV in 2014, the off-road vehicle segment saw a 90% reduction in emissions and Stage V will reinforce this trend.

Despite this challenging background, Safim has nonetheless been growing at a healthy rate, from a 7% compound annual growth rate in the last three years to a double-digit growth rate forecast for the most recent fiscal year, according to the source. The company generated €30m in revenues in 2016, according to press reports.

Following the buyout, the GP aims to focus on strengthening the company's presence in the US and Indian markets and is understood to have already selected senior appointments for the management team, with some other hires to follow. Ambienta aims to double the asset's value within its holding period, focusing in particular on organic growth for the next two years; it is also considering injecting additional capital for add-on acquisitions after this first expansion phase.

People

Ambienta – Nino Tronchetti Provera (co-founder, managing partner); Francesco Lodrini (principal).

Safim – Eronne Mamei (founder, chair).

Advisers

Equity – AlixPartners (commercial due diligence); EY (financial due diligence, ESG due diligence); Ludovici & Partners (legal); Studio Bagni (legal); CBA (tax); Essentia (debt advisory); LMS (legal).

Vendor – Chiomenti (legal).

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds