Ambienta buys Caprari

Ambienta has acquired Italian water pumps manufacturer Caprari, which will be rebranded as Wateralia.

The founding Caprari family will retain a minority stake in the business and Alberto Caprari will be appointed as chair.

Following this deal, Ambienta plans to strengthen Wateralia's market position and build a platform for M&A consolidation across the water pumps production and management sector.

Ambienta has invested in the business via its third fund, which held a final close in May 2018, surpassing its €500m target and hitting its €635m hard-cap.

The fund typically invests equity tickets of €30-100m with underwriting capacity of up to €140m. The target companies are mid-market businesses generating EBITDA of more than €10m from revenues of €30-100m. In terms of entry multiples, Ambienta looks at companies valued in the 5-13x EBITDA multiple bracket, depending on the industry.

Company

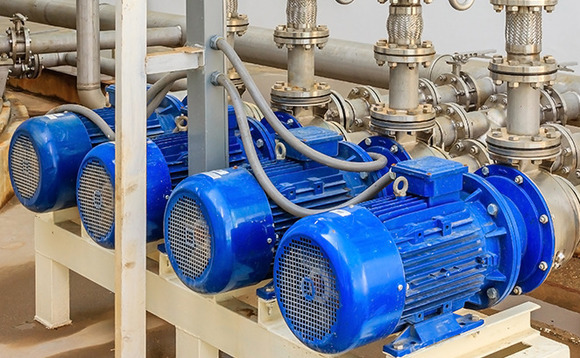

Founded in 1945 and headquartered in Modena, Caprari is a manufacturer of centrifugal pumps and motors for the integrated water cycle.

Its portfolio focuses on three main pump categories: submersible and vertical line; surface; and sewage.

With three production facilities – two in Italy (Modena and Rubiera) and one in Turkey (Konya) – and 600 employees, Caprari sells its products in more than 100 countries worldwide, serving 1,000 clients in various sectors, including the professional agriculture, water and infrastructure, and industrial application segments.

People

Ambienta – Mauro Roversi (partner).

Caprari – Alberto Caprari (chair).

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds