Tech startups power Italian recovery

Vidur Sachdeva examines the role of tech startups in the post-crisis recovery of the Italian private equity industry.

Thanks to a relatively strong start to the year, 2015 saw the Italian economy finally return to growth for the first time in four years. However, the southern European country's journey towards recovery has been long and arduous. Struggling to recuperate from a triple-dip recession, Italy has consistently trailed the Eurozone average growth rate since the onset of the global financial crisis.

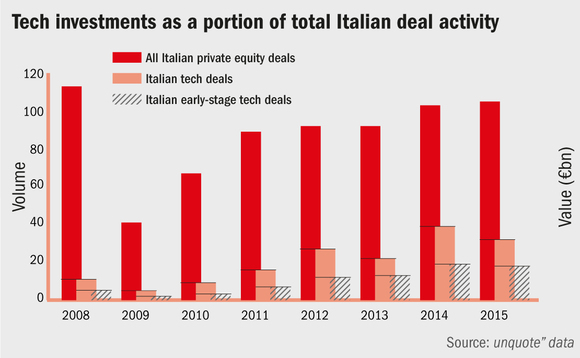

According to unquote" data, the region's private equity industry too fell off a cliff in 2009, dropping from 113 deals worth €10.9bn in 2008 to 41 deals worth €2.2bn. In other words, aggregate volume slipped 64% while value dropped by 80% in the space of a year.

Since then, however, the regional industry has demonstrated resilience and consistency: deal activity improved nearly every single year, slowly but surely inching closer and closer to pre-crisis levels. 2015 saw Italy become home to 105 deals worth €15.9bn - deal volume remained just 7% below the 113 transactions noted in 2008 while total value surpassed pre-crisis levels by 46%.

Tech drive

A closer look at the data reveals that Italy's recovery has been fuelled by a rather unexpected source: tech startups. Although the fourth largest economy in Europe, Italy is not the first country that comes to mind when thinking of innovative, business-friendly locations on the continent. Yet, tech startups have accounted for an increasingly larger share of the country's private equity dealflow.

Back in 2008, the technology sector accounted for 11 transactions, of which five were early-stage transactions. As the financial crisis unfolded, tech deals declined to five transactions in 2009, of which just two were in the early-stage category. However, during 2015, there were as many as 32 private-equity-backed tech deals in Italy, with early-stage deals accounting for 18 of those transactions.

Viewed from another angle, although tech startups accounted for just 4.4% of the regional private equity industry's dealflow in 2008, this estimate had nearly quadrupled to 17.1% by the end of 2015.

Of course, Italy still has a lot of work to do if it hopes to catch up to the UK or Germany, which are traditionally seen as Europe's startup hubs. Still, these trends should give GPs and budding entrepreneurs much hope as it does appear that the country has been moving in the right direction.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds