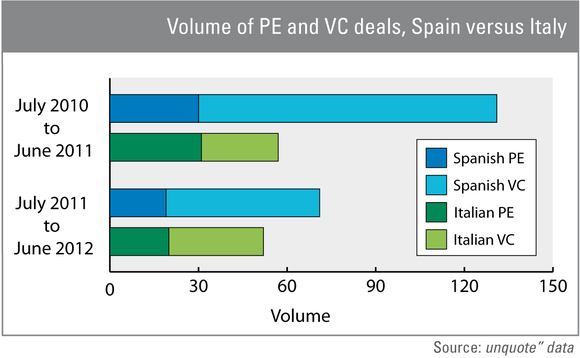

Spain continues to outperform Italy in deal volume

Despite the country's dire economic state, Spanish private equity activity has continued to outpace that of Italy continuously over the past 24 months - although the latter showed more resilience last year.

The Eurozone crisis might be at its most extreme in Greece, but it hasn't spared its Southern European neighbours Italy and Spain. Both countries are in dire need of capital and Spain's worries are arguably more pressing than Italy's. Yet, the former continuously outpaced Italy in terms of private equity and venture capital activity over the past months.

From July 2010 – when Greece's crisis progressively unravelled – to June 2011, Spanish venture capital dealflow remained sizeable with 101 deals recorded, where Italy only saw 26 transactions being completed. Unsurprisingly, Spanish activity dipped between July 2011 and June 2012 as the state of the country worsened, with venture deals almost halving, but still dwarfing Italian deal volume.

Italy launched a national incentive to encourage investments in SMEs, Fondo Italiano di Investimento, which began investing in summer 2010. Despite this effort to counteract the tough economic environment, unquote" data shows investment volume in Italy has risen by 23% between the two years in the sample. The increase sounds significant, but only translated to 6 deals. That said, dealflow in the country remained more stable than in Spain, notably with regards to VC activity.

Many Italian SMEs are family-run businesses, which are often alienated by the idea of foreign private equity ownership, while alternative investments are more established in Spain. Yet Italy's financial infrastructure is much more resilient than the Spanish one, which should nudge investors towards the Iberian peninsula.

As the crisis continues to bite, it remains to be seen if Spain can keep up its performance and contain the erosion in venture activity, and if Fondo Italiano will be able to step up Italy's game.

Latest News

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Sponsor acquired the public software group in July 2017 via the same-year vintage Partners Group Global Value 2017

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Czech Republic-headquartered family office is targeting DACH and CEE region deals

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Ex-Rocket Internet leader Bettina Curtze joins Swiss VC firm as partner and CFO

Stonehage Fleming raises USD 130m for largest fund to date, eyes 2024 programme

Estonia-registered VC could bolster LP base with fresh capital from funds-of-funds or pension funds